Permalink: https://stockupdate24.com/dollar-vs-rupee-2-sept-2025

Category: Explainer | Opinion | Currency & Markets

Tags: Dollar vs Rupee 2 Sept 2025, INR at 88, Currency battle, Oil price impact, Indian economy

Focus Keyword: Dollar vs Rupee 2 Sept 2025

Meta Description: Dollar vs Rupee 2 Sept 2025: INR at 88 sparks debates on trade, inflation, exports, and oil impact. Full explainer with Indian context, global cues, and investor view.

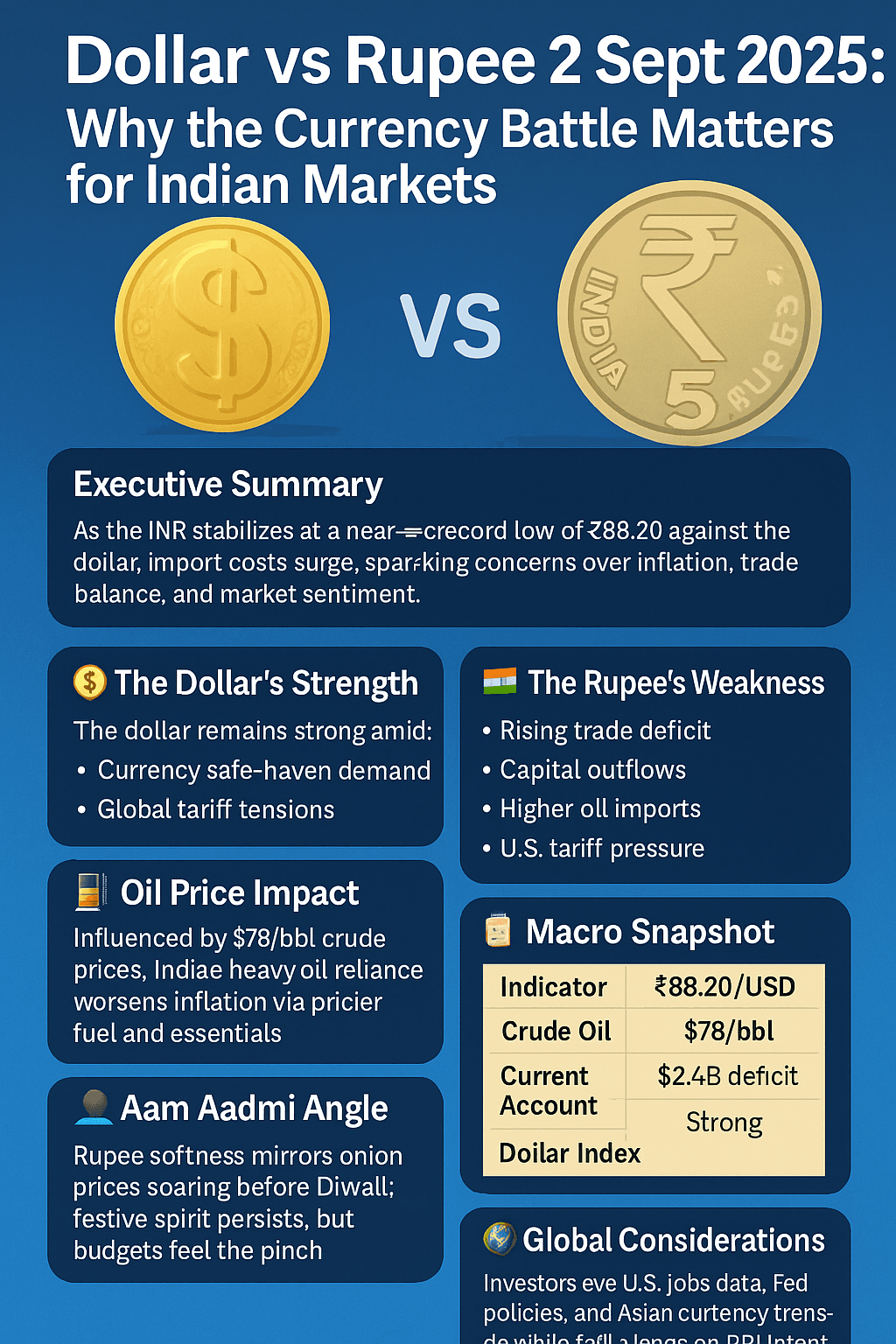

📰 Executive Summary

The Dollar vs Rupee 2 Sept 2025 story is at the center of India’s economic debate. The rupee touched a record low of ₹88.33 against the U.S. dollar before stabilizing near ₹88.20 with RBI intervention. While exporters cheer, importers and consumers face rising costs. The battle between dollar strength and rupee weakness is shaping inflation, trade balance, and stock market sentiment. (Reuters)

💸 The Dollar’s Strength

The U.S. dollar remains strong as investors flock to safe assets amid global tariff tensions. Federal Reserve’s cautious stance and resilient U.S. economy have boosted the dollar index. A strong dollar usually means emerging market currencies like the rupee face pressure. (Reuters)

🇮🇳 The Rupee’s Weakness

On 1 Sept, rupee hit ₹88.33/USD, a lifetime low, before RBI stepped in with interventions to cool volatility. Key reasons for weakness:

- Rising trade deficit – $2.4B current account deficit in Q1 FY26 (Reuters)

- Capital outflows by Foreign Portfolio Investors (FPIs)

- Higher oil import bill

- Global tariff tensions with U.S.

⛽ Oil Price Impact

India imports nearly 85% of its crude oil. With crude hovering near $78/bbl, rupee weakness directly inflates the oil bill. Higher oil prices mean costlier petrol, diesel, and cooking gas—translating into inflationary pressures for the common man. For retail investors, this is like paying extra for the same plate of pani puri—painful on the pocket.

📊 Impact on Sectors

- Exporters: IT, pharma, and textile companies benefit from a weak rupee as they earn in dollars.

- Importers: Oil refiners, aviation companies, and electronic importers suffer from higher costs.

- Banks & NBFCs: Higher bond yields and currency volatility add to funding stress.

- Consumers: Daily essentials like fuel, edible oil, and electronics become costlier.

📋 Macro Snapshot – Dollar vs Rupee 2 Sept 2025

| Indicator | Reading | Impact |

|---|---|---|

| Rupee | ₹88.20/USD | Near record low |

| Crude Oil | $78/bbl | Rising import bill |

| CAD | $2.4B deficit | Trade gap widens |

| Dollar Index | Strong | Global EM pressure |

👥 Indian Touch – Aam Aadmi Angle

For the common Indian, rupee weakness is like onion prices doubling before Diwali—festivities remain but budgets get tighter. Exporters may celebrate, but the household budget feels the pinch. Investors need to treat this like spicy pani puri—exciting in the moment but may cause heartburn if consumed recklessly.

🌐 Global Cues

Global markets are closely watching U.S. jobs data and Fed policy cues. Asian currencies like Yen and Yuan are also under pressure. Tariff tensions between U.S. and emerging markets may keep the dollar strong in the near term. India needs strong FPI inflows and RBI support to stabilize the rupee.

❓ FAQs – Dollar vs Rupee 2 Sept 2025

- Q1. Why is the rupee weak?

Trade deficit, FPI outflows, oil imports, and U.S. tariff pressure. - Q2. Who benefits from a weak rupee?

Exporters like IT and pharma companies. - Q3. Who suffers from a weak rupee?

Importers, consumers, and oil companies.

🔎 People Also Ask

- Q4. How does a weak rupee affect stock markets?

Positively for exporters, negatively for importers and consumer sectors. - Q5. Can RBI control the rupee?

RBI intervenes to smooth volatility, but fundamentals matter. - Q6. Is weak rupee always bad?

No—helps exports but hurts imports. Balance is key.

✅ Conclusion

The Dollar vs Rupee 2 Sept 2025 battle is shaping India’s economy. With rupee at ₹88, oil at $78, and trade deficit widening, challenges persist. But India’s growth resilience, RBI’s intervention, and exporter gains provide balance. For investors, it’s about managing spice levels—enjoy the benefits but prepare for inflationary heat. A balanced portfolio, like a balanced thali, will help ride this storm.