📰 Executive Summary

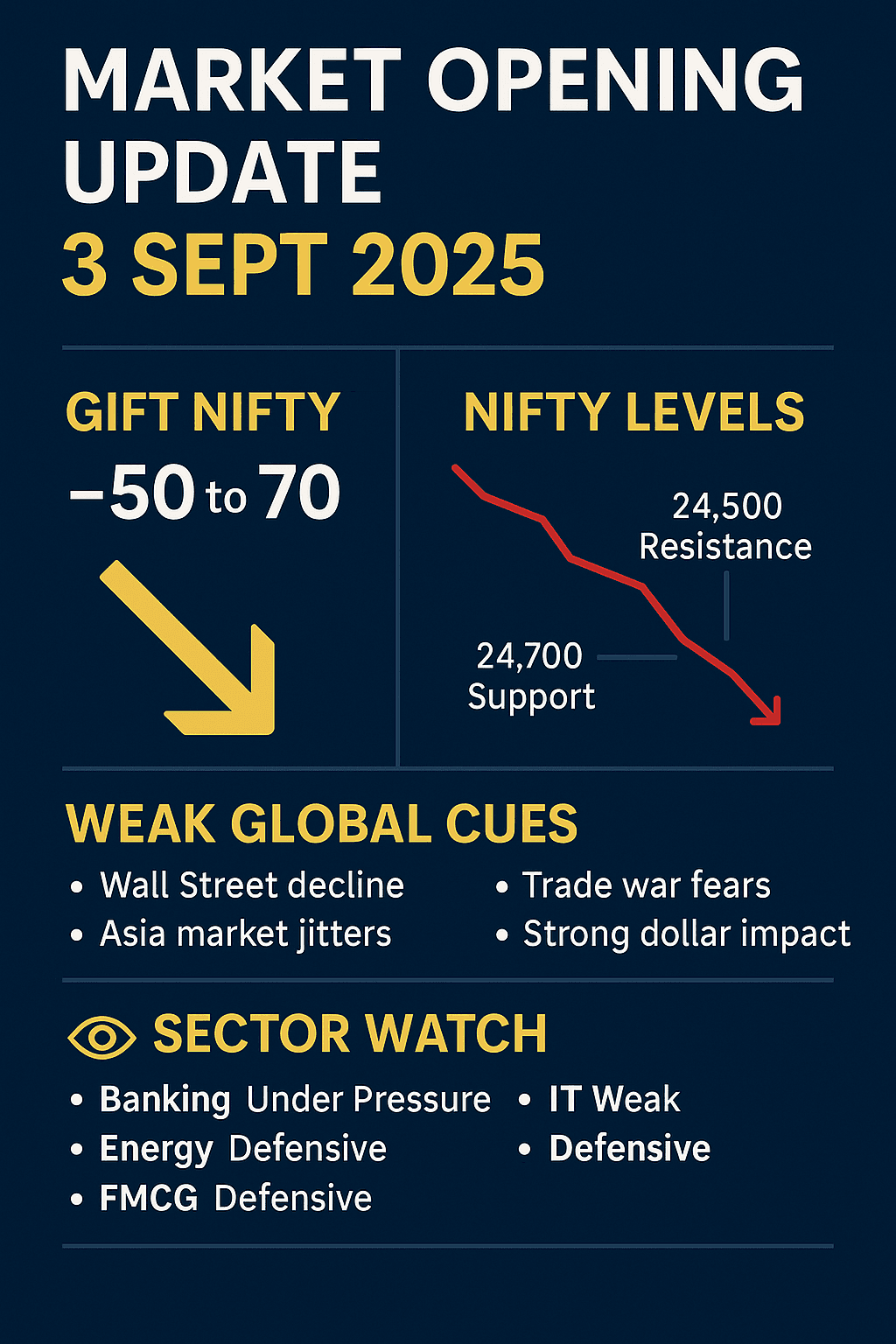

The Market Opening Update 3 Sept 2025 suggests a soft start for Dalal Street, with GIFT Nifty down by 50–73 points. Weak global cues, tariff worries, and expiry-week volatility are weighing on sentiment. Nifty support lies at 24,500, while resistance levels stand at 24,700–24,850. Traders are expected to remain cautious as GST Council updates and FII flows guide intraday moves. (Reuters)

🌏 Global Cues – Setting the Stage

- Wall Street: US markets closed lower on Sept 2, with the Nasdaq dragging due to tech weakness. Dow Jones -0.2%, Nasdaq -0.4%. (Mint)

- Asian Markets: Nikkei down ~0.4%, Hang Seng weak, Shanghai Composite mildly lower. Trade war and tariffs dominate headlines.

- European Futures: FTSE and DAX futures indicate a flat-to-weak open later today.

- Commodities: Brent crude steady at $78/bbl; Gold holds firm at $2,475/oz as safe-haven demand rises.

- Dollar Index: At 104+, pressuring EM currencies including INR.

📉 GIFT Nifty Signals – The Pre-Market Mood

GIFT Nifty, trading near 24,610–24,618, is down 49–73 points versus Nifty’s previous close, pointing to a cautious start. (DSIJ)

⚖ Support & Resistance Levels

- Immediate Support: 24,500, then 24,350.

- Immediate Resistance: 24,700–24,850.

- Technical Indicators: RSI below 50, MACD showing mild bearish crossover, suggesting limited upside.

🏦 FII/DII Data

Foreign Institutional Investors (FIIs) sold equities worth ₹1,200 crore on Sept 2, while Domestic Institutional Investors (DIIs) bought ₹950 crore, balancing the market. FII outflows remain a risk amid a strong dollar. (ET)

🏭 Sectoral Watch

- Banking: Could remain weak as higher bond yields hurt margins.

- IT: Weak due to Nasdaq tech pressure, but rupee at 88/USD offers support.

- Auto: Festive demand supportive, but crude-linked costs remain a risk.

- Energy: Reliance, ONGC, and power PSUs may stay in focus amid GST reforms.

- FMCG: Defensive buying likely, rural recovery continues to help volume growth.

📋 Snapshot Table

| Indicator | Value | Implication |

|---|---|---|

| GIFT Nifty | 24,610–24,618 | Gap-down opening |

| Support | 24,500 / 24,350 | Watch for breakdown |

| Resistance | 24,700–24,850 | Upside capped |

| FII Flow | -₹1,200 Cr | Outflow risk |

| DII Flow | +₹950 Cr | Supportive |

| Global Markets | US & Asia weak | Negative cue |

👥 Indian investor

For Indian investors, today’s market is like a cricket match in monsoon season—players are ready, but rain clouds hover. Nifty’s 24,500 is the umbrella level; if it breaks, you might get wet. Banking feels like the spicy pickle—too sharp today; FMCG like plain rice—comforting in volatility. Balance is the mantra, just like balancing a thali with sweet, spice, and dal.

❓ FAQs – Market Opening Update 3 Sept 2025

- Q1. Why is the market opening weak?

Due to global tariff worries, weak Wall Street, and F&O expiry pressure. - Q2. Key levels for Nifty today?

Support at 24,500 and 24,350; resistance at 24,700 and 24,850. - Q3. Which sectors to watch?

FMCG and energy defensive; banking and IT under pressure.

🔎 People Also Ask

- Q4. Is it safe to buy on dips today?

Safe only in defensive stocks; traders must keep stop-loss tight. - Q5. How does rupee at 88 impact markets?

Positive for IT exporters, negative for oil importers and inflation. - Q6. Will GST Council outcome affect markets?

Yes, tax reforms may support consumption and PSU sentiment.

✅ Conclusion

The Market Opening Update 3 Sept 2025 signals a cautious, gap-down start. GIFT Nifty’s 50–70 point decline aligns with weak global cues. Nifty’s support at 24,500 will be critical; if held, range-bound trade possible, else downside may open. Investors should stay stock-specific, watch sector rotation, and remember that in a volatile market, discipline is the real safety net.