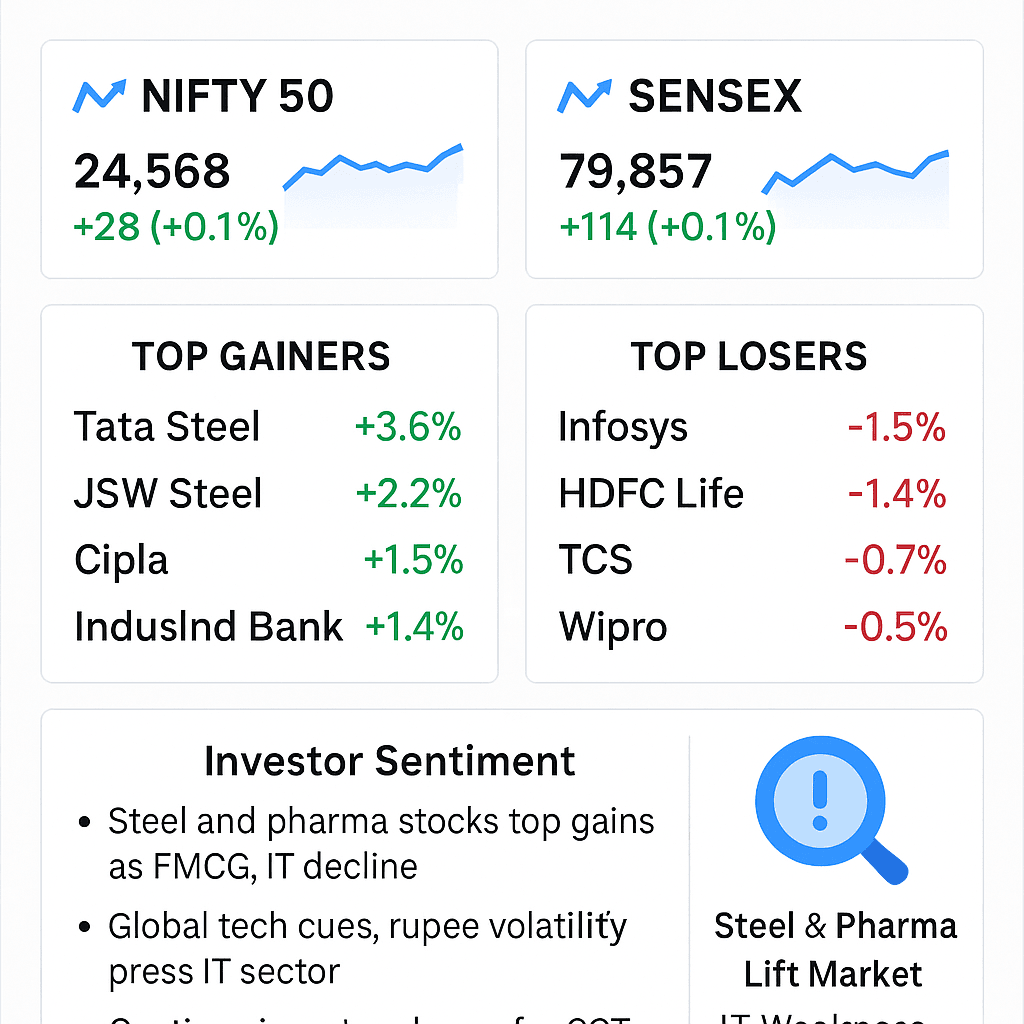

📰 Market Snapshot at Mid-Day

At mid-day, the ”Sensex trades flat-to-positive” and the “Nifty holds above 24,550”, with action driven by metals, pharma, and select financials. On the flip side, IT stocks remain under pressure as global tech weakness and rupee volatility weigh. Investors remain cautious with the GST Council meet and expiry week dynamics in focus. (Economic Times Live Blog)

🚀 Top Gainers & Losers

- Top Gainers: – **Tata Steel** +3.6% – **JSW Steel** +2.2% – **Titan** +1.7% – **Cipla** +1.5% – **IndusInd Bank** +1.3% (ET Now)

- Top Losers: – **Infosys** −1.5% – **HDFC Life** −1.4% – **TCS** −0.7% – **Tech Mahindra** −0.7% – **Tata Consumer** −0.7% – **Wipro** −0.5% (ET Now)

🏭 Sectoral Performance

The action is highly sector-specific:

- Metals: Tata Steel and JSW lead gains on hopes of infra CAPEX and supportive GST tweaks.

- Pharma: Cipla and Sun Pharma attract defensive buying as investors hedge against volatility.

- Banking: IndusInd and Kotak trade firm, but PSU banks flat.

- IT: Infosys, TCS, Wipro weak on global Nasdaq cues and rupee swings near 88/USD.

- FMCG: Titan resilient with festive demand; Tata Consumer softer after profit booking.

- Auto: Mixed—Maruti flat, Hero MotoCorp slightly positive after August sales beat.

🌍 Global Market Cues

Global mood is mixed: – **Wall Street** ended lower on Sept 2 as tariff tensions returned. – **Asian peers** like Nikkei and Hang Seng are subdued. – **Oil** hovers near $78/bbl, keeping inflation watch alive. – **Gold** steady at $2,475/oz as investors seek safety. – **Dollar Index** firm above 104, continuing to pressure emerging market currencies. (Mint)

📈 Technical Intraday View

- Nifty Spot: 24,550–24,580

- Support: 24,500 / 24,350

- Resistance: 24,700 / 24,850

- Sensex: Flat near 79,900

- Indicators: RSI ~49 (neutral-bearish), MACD flat, volume slightly thin.

💰 FII & DII Activity

On Sept 2, **FIIs sold equities worth ~₹1,200 crore**, while **DIIs bought ~₹950 crore**, balancing flows. Mid-day provisional numbers show DIIs continuing selective support, especially in metals and pharma. (ET Markets)

📋 Mid-Day Snapshot Table

| Index | Level | Trend |

|---|---|---|

| Nifty 50 | 24,550–24,580 | Flat-to-positive |

| Sensex | 79,900 | Flat |

| Star Sectors | Metals, Pharma | Strong |

| Weak Sectors | IT, FMCG | Under pressure |

| Sentiment | Cautiously Optimistic | Expiry week volatility |

🇮🇳 Indian Investor

For aam investors, today’s market feels like sipping chai with samosa—warm, flavorful, but with hidden spice. Steel and pharma stocks are the crispy samosa of the plate—spicy and satisfying. IT feels like that extra mirchi chutney—burns if you don’t handle carefully. The key is balance, just like a thali: a mix of comfort (FMCG), spice (metals), and sweet (Titan with festive demand).

❓ FAQs – Mid-Day Market Update 3 Sept 2025

- Q1. Why are steel stocks rallying?

On CAPEX optimism and GST tweaks boosting infra demand. - Q2. Why is IT weak today?

Global Nasdaq drag + rupee volatility pressuring margins. - Q3. Which sectors look defensive?

Pharma and FMCG remain safe bets in volatility.

🔎 People Also Ask

- Q4. Is today’s rally broad-based?

No—gains are concentrated in metals and pharma. - Q5. Should investors buy IT on dips?

Selective buying only; wait for rupee stabilization. - Q6. Will GST Council outcome affect afternoon trade?

Yes—consumption and PSU sentiment hinge on announcements.

✅ Conclusion

The Mid-Day Market Update 3 Sept 2025 shows cautious optimism: Nifty steady above 24,550 with metals and pharma lifting mood, while IT and FMCG drag. With expiry week volatility and GST cues in play, selective stock picking remains key. For traders, today’s session is like a cricket match in humid weather—patience, hydration, and sharp reflexes will decide who scores runs.