📰 Executive Summary

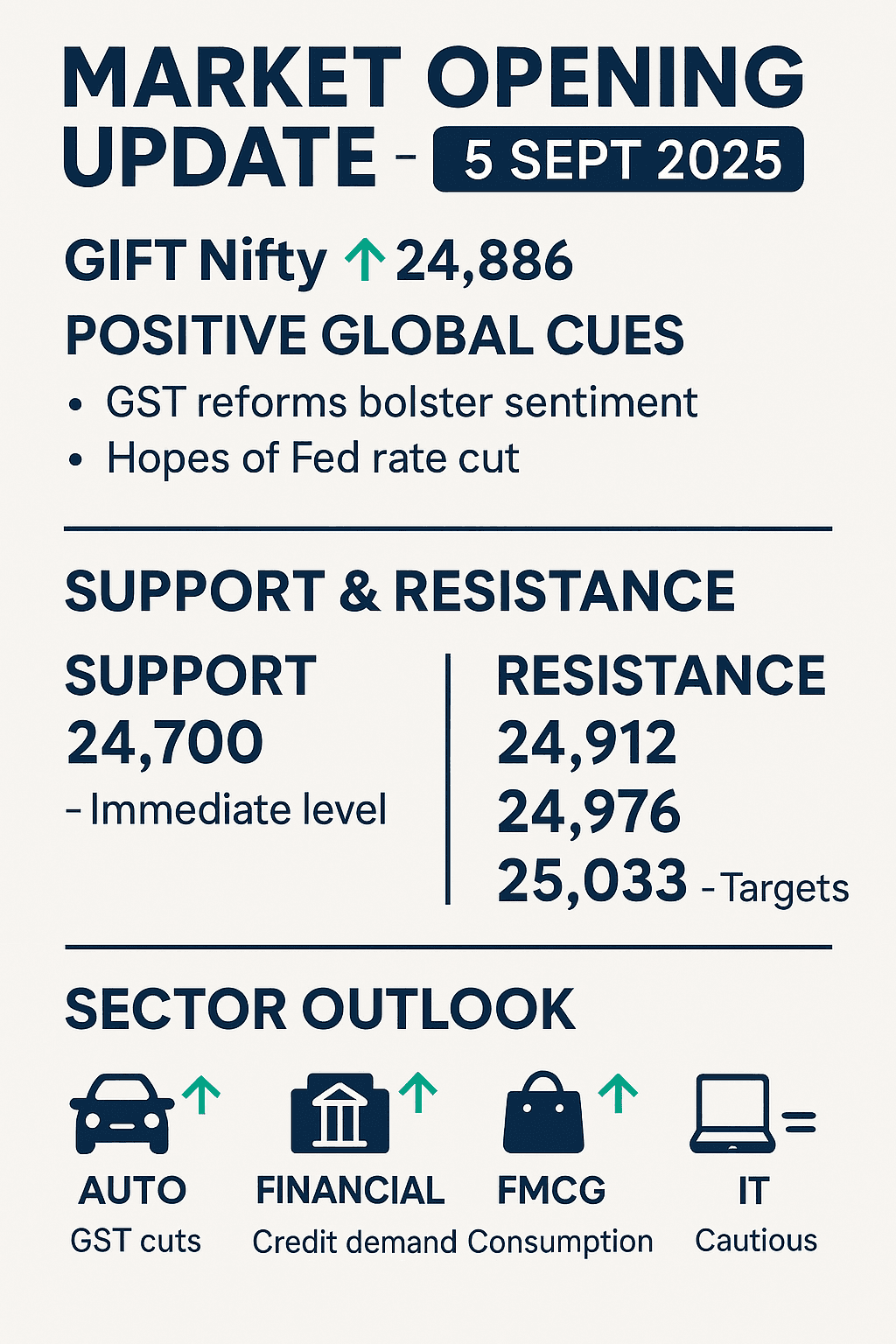

Indian equity markets are expected to open on a bright note on Friday, 5 September 2025. With GIFT Nifty trading 150 points higher around 24,886, Dalal Street looks set for a strong start. Optimism stems from the government’s tax reform measures, particularly GST rationalisation, along with renewed hopes of a US Federal Reserve rate cut. Investors are also factoring in softer U.S. job data, which increases the likelihood of accommodative global monetary policy. (Reuters)

🌍 Global Cues Driving Sentiment

Global markets have set a supportive tone for Indian equities today:

- Wall Street: The S&P 500 gained nearly 1%, while Nasdaq surged over 1.5%, as traders bet on early rate cuts following dovish Fed commentary. Dow Jones also ended higher, underpinned by strong tech earnings. (Reuters)

- US Jobs Data: Softer non-farm payroll numbers suggested cooling inflationary pressure, fuelling expectations that the Fed might move towards a rate cut in the coming months.

- Asian Markets: Nikkei and Hang Seng both traded in the green, supported by stronger capital inflows. Shanghai Composite rose on stimulus measures in China, adding to positive sentiment across Asia. (ET Markets)

- Crude Oil: Prices remain steady near $76 per barrel, offering comfort to India’s import bill. However, investors remain cautious about potential volatility due to Middle East tensions.

📈 GIFT Nifty Signals – A Strong Start

As of early trade, GIFT Nifty was up around 150 points at 24,886, hinting at a gap-up opening for Nifty 50. This suggests markets may attempt to reclaim 25,000 levels during the day. The optimism is directly tied to expectations that GST cuts will boost consumption and that US Fed action will ease global liquidity conditions. (ET Markets)

⚖ Key Support & Resistance Levels

According to market analysts and technical charts:

- Immediate Support: 24,700 – tested in the previous session and seen as a firm base. (Moneycontrol)

- First Resistance: 24,912 – a psychological barrier. A breakout here may attract strong momentum buying.

- Higher Resistances: 24,976 and 25,033 – levels to watch if Nifty maintains its bullish tone.

🔔 Opening Bell Sentiment

Traders are preparing for a positive start with an upward bias. Auto, FMCG, and banking stocks are expected to lead the rally, while energy shares may lag due to muted global oil demand trends. Domestic investors are buoyed by hopes that GST cuts will revive consumption and bring relief to household budgets. Foreign Institutional Investors (FIIs) may also return after heavy outflows in August, encouraged by global liquidity cues. (Reuters)

📊 Sectoral Outlook

- Auto: Expected to gain from GST rate cuts on vehicles and rising festive demand.

- Banking: Private banks likely to benefit from strong credit demand and stable NIM outlook.

- FMCG: Consumption boost anticipated as tax reforms lower costs.

- IT: Cautious; global clients still holding back budgets despite positive liquidity signals.

- Metals: May see selective buying on global stimulus hopes, but volatility persists.

🧾 Snapshot Table

| Indicator | Level / Trend | Take-away |

|---|---|---|

| GIFT Nifty | 24,886 (+150) | Positive gap-up opening |

| Support | 24,700 | Strong base |

| Resistance | 24,912 / 24,976 / 25,033 | Upside breakout levels |

| Global Cues | Positive | Rate-cut optimism & GST reforms |

| Sector Bias | Auto, FMCG, Banks | Likely leaders |

🇮🇳 Human & Indian Touch

For Indian retail investors, today’s market feels like the festive season coming early. Just as households look for discounts in Ganesh Chaturthi shopping, investors are eyeing GST reforms as “discounts” on consumption-led growth. Auto showrooms are expected to see higher footfalls, and FMCG companies may pass on tax savings to customers, boosting confidence in the common man’s wallet. For the aam investor, today’s rally is like seeing Diwali lights switch on a little earlier than expected.

❓ FAQs

- Q1. Why is Nifty expected to open higher on 5 Sept 2025?

Because of GST rationalisation measures and expectations of a US Fed rate cut, supported by positive global markets. - Q2. What sectors are likely to lead today’s rally?

Auto, FMCG, and banking are expected to gain the most, while energy may remain subdued. - Q3. What is the key resistance for Nifty today?

24,912 is the first hurdle, followed by 24,976 and 25,033. - Q4. Should retail investors buy at opening?

Caution is advised—entering after the first 30 minutes helps avoid volatility traps.

📌 People Also Ask

- Will GST cuts revive consumption demand in India?

- Is 25,000 a sustainable level for Nifty in September?

- How will US Fed’s rate cut impact Indian markets?

- Which stocks benefit the most from GST reforms?

✅ Conclusion

The Market Opening Update for 5 Sept 2025 suggests a positive start for Indian equities, with Nifty likely to approach 25,000. Global cues, GST cuts, and rate-cut hopes have created a favorable backdrop. However, traders should watch for profit-booking near resistance zones. For long-term investors, today’s move is less about chasing intraday highs and more about understanding how structural reforms like GST feed into India’s broader growth story.