.

📌 Introduction

On 5 September 2025, Indian stock markets are trading cautiously near 24,700 on the Nifty, balancing GST optimism with global uncertainty. As investors hunt for opportunities, we bring you the Top 5 Stocks to Watch Today, based on live data and sector trends. (Moneycontrol)

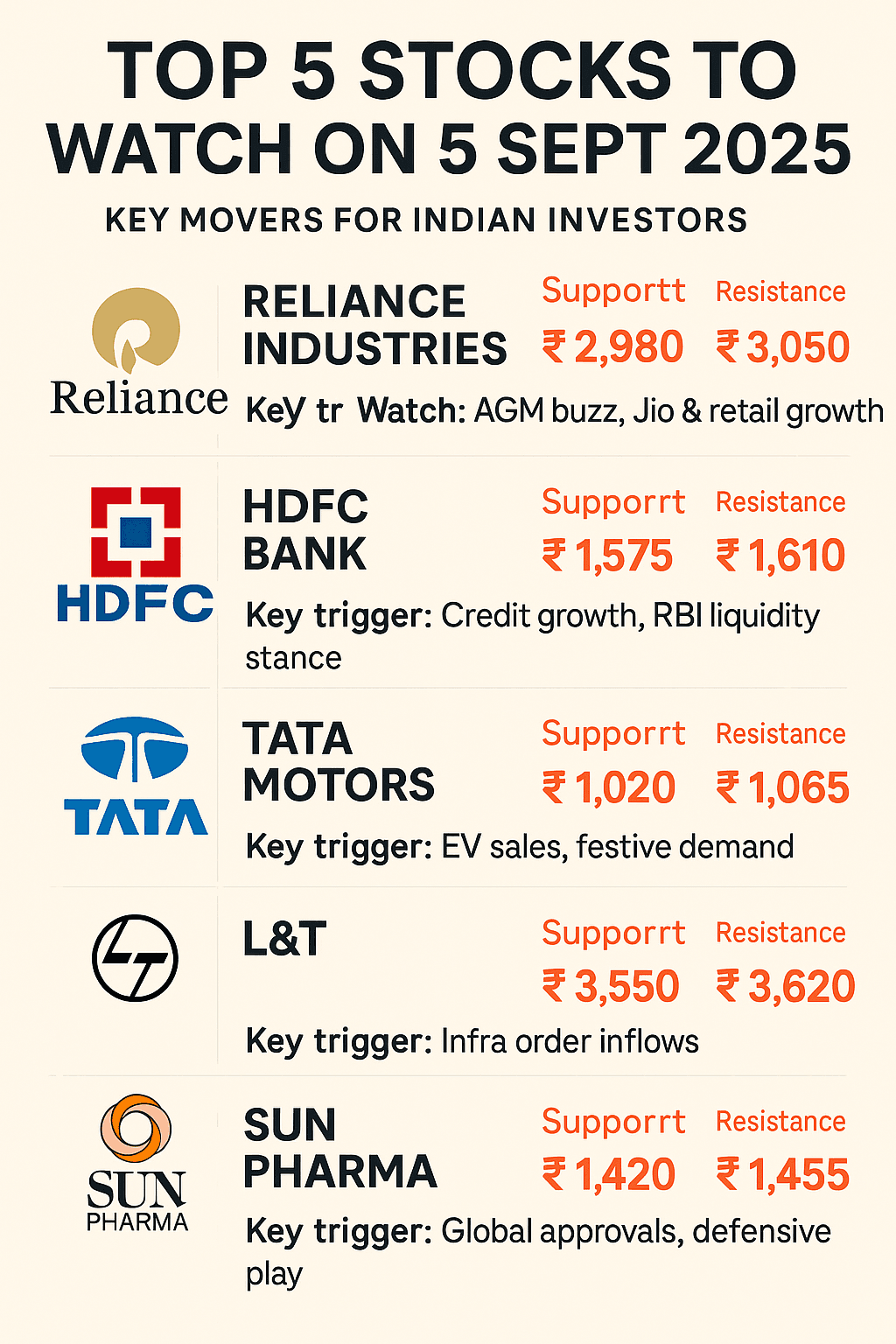

📊 1. Reliance Industries (RIL)

Why to Watch: Reliance remains a market heavyweight. Ahead of its AGM, buzz around Jio Financial Services and retail expansion has kept investor interest high. (Reuters)

- Support: ₹2,980

- Resistance: ₹3,050

- Investor View: Analysts suggest that if RIL sustains above ₹3,050, the next target could be ₹3,120. (NSE India)

🏦 2. HDFC Bank

Why to Watch: As the banking sector reacts to RBI’s liquidity operations, HDFC Bank is at the centre of action. Credit growth remains a key driver. (BSE India)

- Support: ₹1,575

- Resistance: ₹1,610

- Investor View: Sustaining above ₹1,600 may attract fresh buying. Long-term investors remain confident thanks to stable asset quality. (Moneycontrol)

⚙️ 3. Tata Motors

Why to Watch: Auto stocks are buzzing after GST cuts. Tata Motors is gaining traction with its EV launches and festive season demand outlook. (ET Markets)

- Support: ₹1,020

- Resistance: ₹1,065

- Investor View: Delivery-based buying could take the stock towards ₹1,100. (NSE India)

🏭 4. Larsen & Toubro (L&T)

Why to Watch: The infra major has reported strong order inflows in Q2. Government’s continued focus on infrastructure makes L&T a stock to track. (Reuters)

- Support: ₹3,550

- Resistance: ₹3,620

- Investor View: Positional investors can hold. Above ₹3,620, a move towards ₹3,700 is likely. (Moneycontrol)

💊 5. Sun Pharma

Why to Watch: Pharma is back in focus as global regulators approve new drugs. Sun Pharma, with strong US exposure, remains a defensive bet. (BSE India)

- Support: ₹1,420

- Resistance: ₹1,455

- Investor View: Defensive allocations from mutual funds are keeping Sun Pharma in demand. (Moneycontrol)

🌍 Sectoral Context

Sector-wise, autos and infra are leading gains, while FMCG remains under pressure due to profit booking. Pharma is emerging as a safe sector, balancing volatility in IT and banking. (Reuters)

💰 FII/DII Flows

FIIs were net sellers in IT but net buyers in autos and infra. DIIs absorbed pressure by accumulating blue chips like Reliance and HDFC Bank. (Moneycontrol)

📊 Snapshot Table

| Stock | Support | Resistance | Key Trigger |

|---|---|---|---|

| Reliance Industries | ₹2,980 | ₹3,050 | AGM buzz, Jio & retail growth |

| HDFC Bank | ₹1,575 | ₹1,610 | Credit growth, RBI liquidity stance |

| Tata Motors | ₹1,020 | ₹1,065 | EV sales, festive demand |

| L&T | ₹3,550 | ₹3,620 | Infra order inflows |

| Sun Pharma | ₹1,420 | ₹1,455 | Global approvals, defensive play |

🇮🇳 Indian Investor Angle

For retail investors, today’s picks are like choosing dishes in a thali. Reliance and HDFC Bank are the “main course” that provide strength, Tata Motors and L&T are the “spicy curries” that bring growth, and Sun Pharma is the “curd” that balances the heat—defensive, steady, and always reliable. (Moneycontrol)

❓ FAQs

- Q1. Which stock has the strongest short-term outlook?

Tata Motors, thanks to GST reforms and EV sales. (ET Markets) - Q2. Is Reliance a good bet before AGM?

Yes, but safe entry is above ₹3,050 breakout. (NSE India) - Q3. Is Sun Pharma defensive for long-term portfolios?

Yes, pharma remains a safe play. (BSE India) - Q4. What’s the key support for Nifty today?

24,700 remains crucial. (Moneycontrol)

🔎 People Also Ask

- Which 5 stocks are best for intraday trading today?

- Are auto stocks the best sector play after GST reforms?

- What is the best defensive stock in volatile markets?

- How do FIIs influence Indian market sentiment?

✅ Conclusion

The Top 5 Stocks to Watch on 5 Sept 2025 include Reliance, HDFC Bank, Tata Motors, L&T, and Sun Pharma. Together they capture India’s growth story—energy, finance, auto, infra, and healthcare. For intraday traders, levels above resistances could open opportunities, while long-term investors can focus on sector leaders. (Reuters)