📝 Introduction

On 15 September 2025, global monetary expectations and domestic currency moves are calling the shots on Dalal Street. Traders are balancing hope of a U.S. Federal Reserve easing with RBI’s tactical interventions aimed at cushioning rupee volatility. This analysis breaks down the macro linkages, sector implications and practical action points for investors and traders.

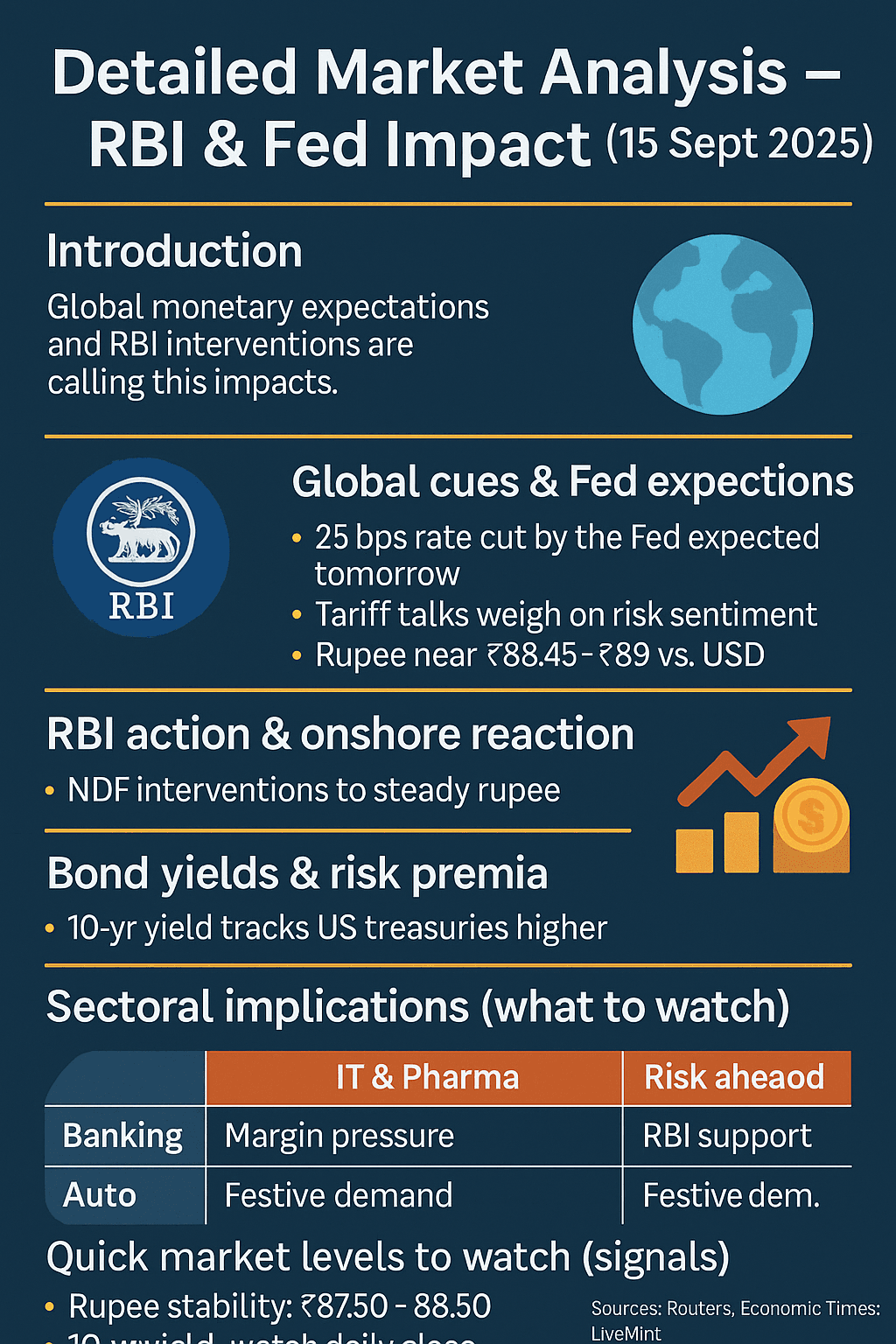

🌍 Global cues & Fed expectations

- Markets broadly price a 25 bps Fed rate cut at the Sept 16–17 meeting, which could ease global liquidity conditions and marginally help emerging markets like India. (LSI: Fed rate cut impact, global liquidity)

- Tariff discussions and trade policy noise in major economies are keeping risk sentiment fragile — a headwind for export-heavy names. (LSI: trade tariffs, export impact)

- The U.S. dollar’s strength has pressured the rupee to ~₹88.45–₹89, adding to importer cost concerns and imported inflation risks. (LSI: rupee vs dollar)

🇮🇳 RBI action & onshore reaction

RBI has been visible in the NDF and onshore markets to arrest sharp rupee weakness. Dealers report targeted interventions that temporarily steady the rupee but do not remove the underlying pressure from higher oil prices and global dollar demand. Forward premiums are elevated as corporates hedge exposures. (LSI: RBI intervention, NDF activity)

📈 Bond yields & risk premia

India’s 10-year benchmark yield nudged higher in sympathy with U.S. treasuries and rising oil. Rising yields, unless reversed by clear dovish signals, can limit multiple expansion for equities and raise borrowing costs for corporates. Watch the 10-year closely for cues on institutional flows. (LSI: 10-year yield India, bond market India)

📌 Sectoral implications (what to watch)

| Sector | Impact | Trade/Invest Tip |

|---|---|---|

| IT & Pharma | Margin pressure from rupee swings & tariff uncertainty | Use hedges; avoid heavy leveraged bets |

| Banking | Short-term stability if RBI supports liquidity; watch credit growth | Focus on high-quality lenders |

| Auto | Festive demand supportive but import costs rise | Prefer domestically focused names |

| Metals & Commodities | Volatility linked to global demand and oil | Keep position sizes small |

🔑 Practical action points (for traders & investors)

- Traders: Keep tight stop losses; trade expiry and intraday volatility with smaller positions. Use options to hedge where available. (LSI: intraday volatility India)

- Long-term investors: Focus on quality large-caps in Auto, Banking and Consumer — sectors with strong domestic demand and pricing power. (LSI: long term stocks India)

- Exporters: Consider structured hedges to lock margins if rupee stays weak. (LSI: currency hedging India)

- Bond investors: Monitor yield curve; prefer short-to-medium duration if yields remain volatile. (LSI: bond strategy India)

📍 Quick market levels to watch (signals)

- Rupee stability zone: ₹87.50 – ₹88.50 (sustained move below/above matters)

- 10-yr yield: watch daily close for breakouts above previous resistance

- Nifty cues: watch support 24,850 and resistance 25,200 for directional bias (internal link: Market Opening Update — 15 Sept)

🔍 Quick FAQ (on-page; also included in FAQ schema)

- Q: How will Fed’s decision affect India?

A: A dovish Fed can ease dollar strength, support rupee and attract FIIs; hawkish or neutral tone can sustain pressure. - Q: Can RBI alone defend the rupee?

A: RBI interventions help in short-term calm but cannot permanently offset structural pressures like oil and trade deficits.

✅ Conclusion

Global monetary policy and domestic currency dynamics are currently the dominant market drivers. For the remainder of the week, the Fed meeting and RBI commentary will set the tone. Keep exposure size managed and prefer sectors with domestic consumption angles unless a clear, sustainable macro turn shows up.