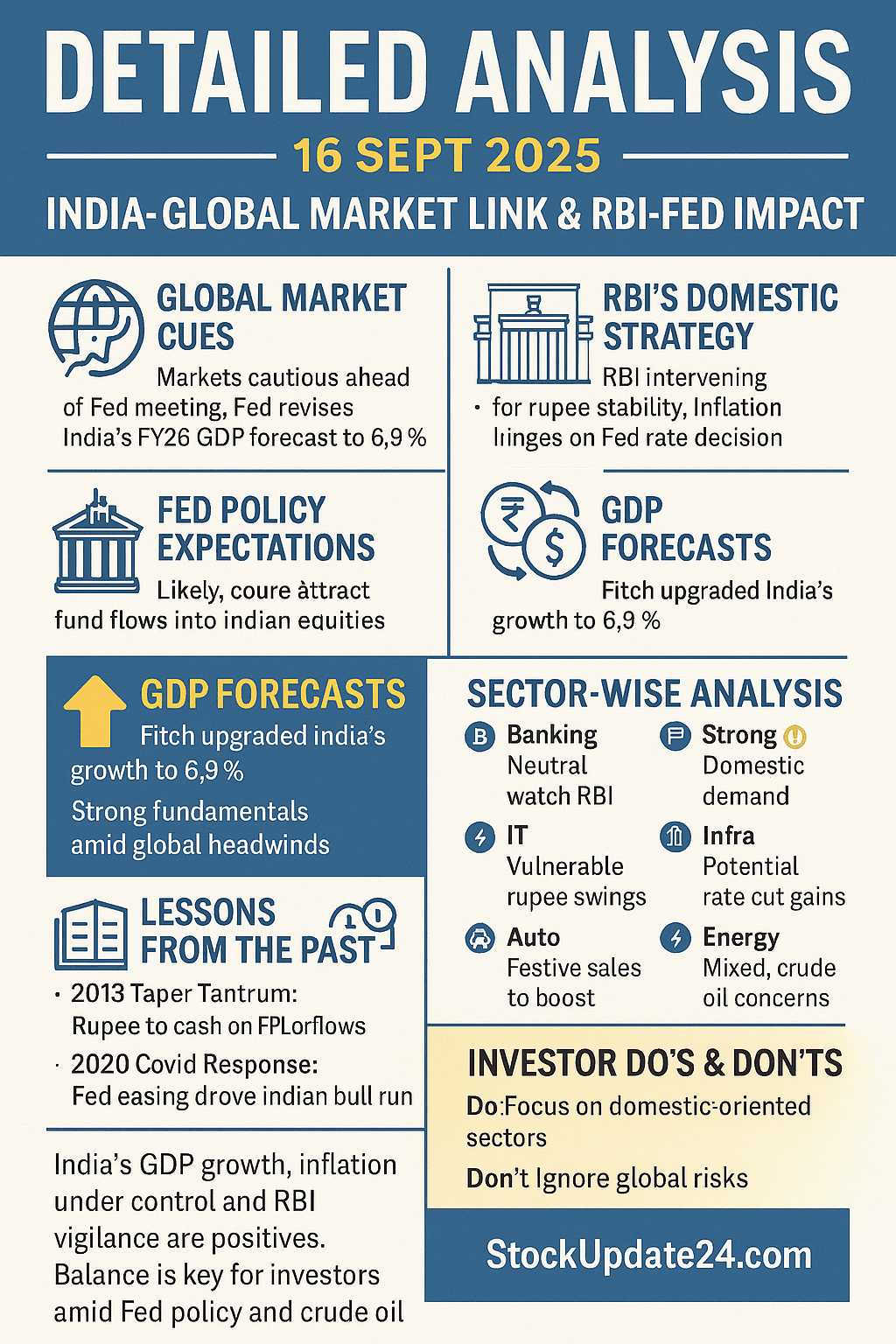

Detailed Analysis 16 Sept 2025: India is balancing global headwinds and domestic strength. Fed’s expected rate cut, RBI’s rupee interventions, and strong GDP forecasts dominate investor focus. Inflation remains under control at 2.07%, Fitch has upgraded India’s growth to 6.9%, and investors are watching rupee stability and global cues closely.

📑 Table of Contents

- Global Market Cues

- Fed Policy Outlook

- RBI’s Domestic Strategy

- Rupee Volatility & Currency Flows

- GDP Forecasts & India’s Growth Story

- Sector-Wise Impact

- Case Study: Fed-RBI Coordination in the Past

- Investor Do’s and Don’ts

- Conclusion

- FAQs

🌍 Global Market Cues

Global markets are cautious ahead of the US Fed meeting. If the Fed delivers a 25 bps rate cut, flows into emerging markets like India could improve. However, tariff worries and crude oil fluctuations remain overhangs. Fitch meanwhile has upgraded India’s FY26 GDP forecast to 6.9% – highest among major economies. (Source: Economic Times)

🔧 Fed Policy Outlook

The Fed’s move is crucial because it affects global capital flows. – Dovish Fed: Weakens USD, boosts rupee, encourages FPIs into India. – Hawkish Fed: Strengthens USD, drains liquidity, pressures Indian equities. Investors must watch not just the cut, but also guidance. (Source: Moneycontrol)

🏛️ RBI’s Domestic Strategy

RBI is ensuring stability by intervening in the NDF (non-deliverable forward) market. Inflation at 2.07% in August gives comfort, while repo rate remains steady at 5.50%. Domestic demand remains strong, allowing RBI some space for rate cuts if global conditions align. (Source: Reuters)

💱 Rupee Volatility & Currency Flows

The rupee touched record lows of ~88.45/USD recently. Main triggers: tariff uncertainty, FPI outflows, and strong dollar positioning. RBI’s interventions have prevented panic. If the Fed cuts rates, rupee could strengthen moderately. (Source: Reuters)

📊 GDP Forecasts & India’s Growth Story

India continues to shine with Fitch projecting 6.9% GDP growth for FY26. Strong consumption, infra push, and services boom are key drivers. Despite global headwinds, India’s fundamentals remain intact.

⚙️ Sector-Wise Impact

- Banking: Neutral – liquidity flows improve if RBI cuts rates.

- IT: Vulnerable – rupee volatility + global tech slowdown weigh on earnings.

- FMCG: Strong – domestic demand + festive season boost.

- Auto: Positive – festive sales + lower financing costs if rate cuts happen.

- Infra/Real Estate: Big beneficiary if RBI eases policy further.

- Energy: Mixed – oil importers at risk if crude spikes; renewables benefit from govt push.

📖 Case Study: Fed-RBI Coordination in the Past

Looking back helps us understand today better. – 2013 Taper Tantrum: Fed hinted at tapering QE → massive FPI outflows from India, rupee crashed to 68/USD. RBI had to hike rates sharply. – 2020 Covid Response: Fed slashed rates + global liquidity boom → India saw record inflows, Sensex/Nifty touched all-time highs in following years. Lesson: Fed moves + RBI actions = huge impact on Indian markets. Today’s setup is somewhere in between – global uncertainty, but strong domestic base.

💡 Investor Do’s and Don’ts

Do’s:

- Stick to quality large caps in FMCG, infra, and banking.

- Use SIPs to average out volatility.

- Track Fed & RBI commentary closely.

- Diversify – don’t put all money in one sector.

Don’ts:

- Don’t chase short-term rallies blindly.

- Don’t over-leverage in currency-sensitive stocks.

- Don’t ignore global cues – India is linked to them.

✅ Conclusion

Detailed Analysis 16 Sept 2025: India’s story is strong – GDP growth, inflation control, and RBI vigilance are positives. Risks remain from Fed policy tone, crude oil, and global trade tensions. For Indian investors, balance is key – focus on domestic demand sectors, hedge risks, and stay patient for long-term rewards. 👉 Live updates available at StockUpdate24.com.

❓ FAQs

- Q: Will RBI cut rates in 2025?

A: Analysts see a chance later this year if global risks ease and inflation stays low. - Q: How does Fed policy impact rupee?

A: Dovish Fed → weak dollar → stronger rupee. Hawkish Fed → strong dollar → weaker rupee. - Q: Which sectors look safer now?

A: FMCG, infra, and autos look safer. IT & exporters face uncertainty. - Q: What should retail investors avoid?

A: Avoid overexposure to IT and oil-dependent sectors. Don’t panic on volatility. - Q: Is India still attractive for global investors?

A: Yes. Despite short-term risks, India’s growth above 6% makes it a structural story.

© 2025 StockUpdate24. Informational content only. Not investment advice.