Permalink: https://stockupdate24.com/dollar-vs-rupee-17-sept-2025

Category: Explainer/Opinion

Tags: Dollar vs Rupee, Rupee Recovery, RBI Policy, Fed Rate Cut, Indian Stock Market

Focus Keyword: Dollar vs Rupee 17 Sept 2025

📌 Quick Take: The Indian rupee recovered to ₹88.05/USD on 17 Sept 2025 after hitting a record low last week. The recovery comes as the US dollar weakens on Fed’s expected rate cut, RBI’s interventions in FX markets, and positive trade talks. Sectors like IT, Pharma, and Oil are directly impacted. (Source: Reuters)

📑 Table of Contents

- 📊 Rupee Trend: Past Month Overview

- ⚡ Why the Rupee is Recovering

- 🏦 Impact on Indian Markets

- 🏛️ RBI’s Role & Fed Policy

- 📉 Dollar vs Rupee – 1 Month Comparison

- 🔍 Sectoral Impact

- ✅ Conclusion

- ❓ FAQs

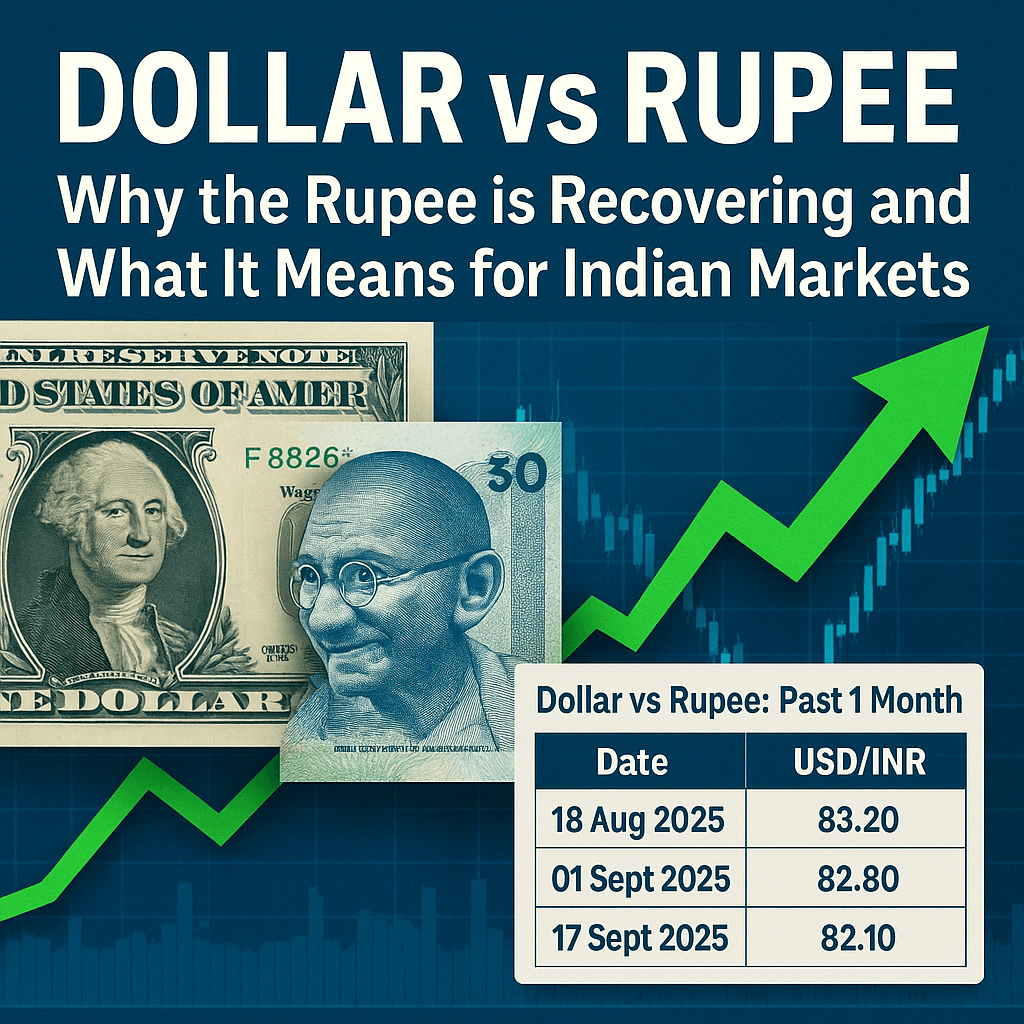

📊 Rupee Trend: Past Month Overview

In early September 2025, the rupee hit a record low of ₹88.45 per dollar due to US tariff pressures and global uncertainty. However, in the last one week, the rupee has staged a recovery to ₹88.05/USD, supported by weakening dollar index, RBI’s market interventions, and optimism in trade talks. (Source: Economic Times)

⚡ Why the Rupee is Recovering

- 📉 Weakening US Dollar: Fed is expected to cut rates, making the dollar less attractive.

- 🏛️ RBI Intervention: RBI stepped up its presence in NDF markets to stabilize volatility. (Source: Reuters)

- 🤝 Trade Talks: India-US trade discussions described as “positive and forward-looking.”

- 🛢️ Oil Prices: Brent crude stable at $77/bbl, easing India’s import bill pressure.

- 📈 Capital Flows: FIIs returning to equities after weeks of outflows.

🏦 Impact on Indian Markets

A stable and recovering rupee has significant implications:

- IT & Pharma: Margins may face mild pressure as rupee strengthens, but global demand remains supportive.

- Importers (Oil, Gold, Electronics): Benefit directly from lower import costs.

- Inflation: Stable rupee helps contain imported inflation, boosting RBI’s confidence in future rate cuts.

- Equity Sentiment: Stronger rupee signals macro stability, improving investor sentiment.

🏛️ RBI’s Role & Fed Policy

The Fed’s expected 25 bps rate cut is a major driver for the dollar weakness. Meanwhile, RBI is expected to cut rates by 50 bps across Oct-Dec 2025, as inflation forecasts fall to 2.4% for FY26. (Source: TOI)

📉 Dollar vs Rupee – 1 Month Comparison

| Date | Rupee vs Dollar | Key Trigger |

|---|---|---|

| 20 Aug 2025 | ₹87.80 | Stable crude, neutral Fed comments |

| 1 Sept 2025 | ₹88.45 (All-time Low) | US Tariff pressures, FII outflows |

| 10 Sept 2025 | ₹88.25 | RBI interventions, oil stable |

| 17 Sept 2025 | ₹88.05 | Fed cut hopes, positive trade talks |

🔍 Sectoral Impact

- Banking & Financials: Benefit from lower inflation outlook and RBI’s dovish stance.

- Autos: Stable rupee + falling input costs support Tata Motors, M&M.

- Energy: OMCs like IOC, BPCL gain from reduced import bill.

- Real Estate: Cheaper borrowing costs if RBI cuts rates later this year.

✅ Conclusion

The rupee’s recovery from all-time lows to ₹88.05/USD signals stability and confidence returning to India’s macro setup. With Fed expected to cut rates, RBI poised to ease policy, and trade tensions showing signs of improvement, the outlook for Indian markets appears optimistic. For investors, sectors like banking, autos, and energy look attractive in the short term, while IT and pharma may see near-term margin adjustments.

❓ FAQs

- Q: Why did the rupee recover on 17 Sept 2025?

A: Fed rate cut hopes, RBI interventions, and positive trade talks. (Source: Reuters) - Q: How does rupee strength affect IT companies?

A: A stronger rupee reduces IT exporters’ margins but demand offsets some impact. - Q: What is the RBI’s policy outlook?

A: Likely two 25 bps cuts by Dec 2025 if inflation remains soft. (Source: TOI) - Q: Which sectors gain from a strong rupee?

A: Import-heavy sectors like oil, autos, and electronics benefit directly.

© 2025 StockUpdate24. Informational content only. Not investment advice.