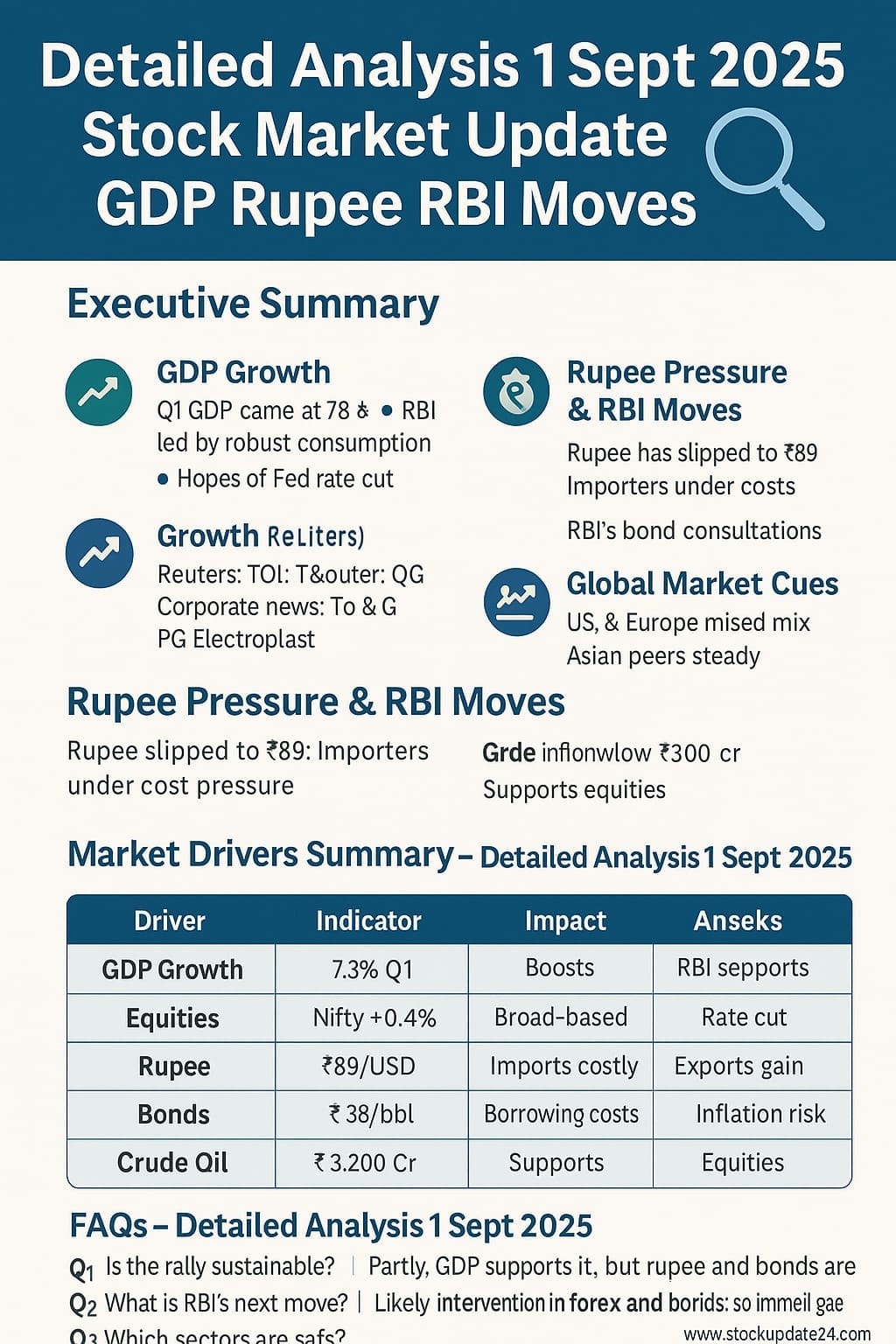

📰 Executive Summary

Detailed Analysis 1 Sept 2025 begins with India’s 7.8% GDP growth, the rupee slipping to ₹89 against the dollar, and RBI’s crucial bond consultation. Alongside, hopes of a Fed rate cut and resilient domestic demand are lifting sentiment. Yet, caution lingers amid currency volatility and bond yield spikes.

🌍 Key Catalysts Driving Markets

- GDP Growth: Q1 FY26 GDP came at 7.8%, led by robust consumption and services growth. (Reuters)

- Equity Rally: Nifty reclaimed 24,500 and Sensex 80,100, led by IT and FMCG. (TOI)

- Corporate Buzz: Torrent Power gained 2.1% after new projects; PG Electroplast rose 2.3%, while Sterlite Tech fell on regulatory issues. (Reuters)

💸 Rupee Pressure & RBI Moves

The rupee touched ₹89/USD, a record low. Import-heavy sectors like oil & gas and airlines are under stress, while exporters like IT benefit. RBI’s bond consultation signals readiness to step in. Bond yields spiked by 20 bps in August, raising corporate borrowing costs.

🌐 Global Market Cues

Wall Street ended August weaker, but futures signal a rebound on Fed rate cut hopes. Asian peers—Nikkei flat, Hang Seng +0.9%—show mixed cues. European equities remain cautious amid trade tensions. Crude oil at $78/bbl keeps inflation fears alive.

📊 Market Drivers Summary – Detailed Analysis 1 Sept 2025

| Driver | Indicator | Impact |

|---|---|---|

| GDP Growth | 7.8% Q1 | Boosts domestic sentiment |

| Equities | Nifty +0.4% | Broad-based rally |

| Rupee | ₹89/USD | Imports costly, exports gain |

| Bonds | Yields +20 bps | Borrowing costs rise |

| Crude Oil | $78/bbl | Inflation risk |

| FPI Flows | ₹3,200 Cr Inflow | Supports equities |

📈 Indian Macro Factors

- Inflation Watch: CPI likely to ease below 5% in September, giving RBI some room.

- Corporate Earnings: IT, banks, and auto reported better-than-expected Q1 numbers.

- Festive Season Effect: FMCG and auto demand expected to rise, boosting Q2 GDP.

💡 Expert Commentary

Market experts say the Detailed Analysis 1 Sept 2025 reflects India’s resilience. According to Motilal Oswal, “Strong GDP growth supports equities, but rupee pressure and bond yields must be watched.” A Mumbai-based trader added, “It’s like the market is enjoying a Diwali sale early, but hidden costs could surprise.”

👥 Retail Investor View

For Indian retail investors, the Detailed Analysis 1 Sept 2025 is encouraging—like finding ₹100 in your wallet. But smart investors will sip the chai slowly, not gulp it down. Caution is key as currency and bond markets remain jittery.

❓ FAQs – Detailed Analysis 1 Sept 2025

- Q1. Is the rally sustainable?

Partly. GDP supports it, but rupee and bonds are risks. - Q2. What is RBI’s next move?

Likely intervention in forex and bonds; no immediate rate cut. - Q3. Which sectors are safe?

IT, FMCG, and select midcaps look resilient.

🔎 People Also Ask

- Q4. Why does rupee weakness hurt?

It inflates import bills and weakens corporate margins. - Q5. Will Fed rate cuts help India?

Yes, they could ease FPI outflows and stabilize the rupee. - Q6. What should retail investors do?

Stay diversified—don’t bet all on one sector.

✅ Conclusion – Detailed Analysis 1 Sept 2025

The Detailed Analysis 1 Sept 2025 highlights strong GDP, rupee weakness, RBI’s proactive stance, and global cues shaping Dalal Street. Optimism is high, but investors must balance risk and reward. Diversification, disciplined SIPs, and patience remain the best strategies in September 2025.