📰 Executive Summary

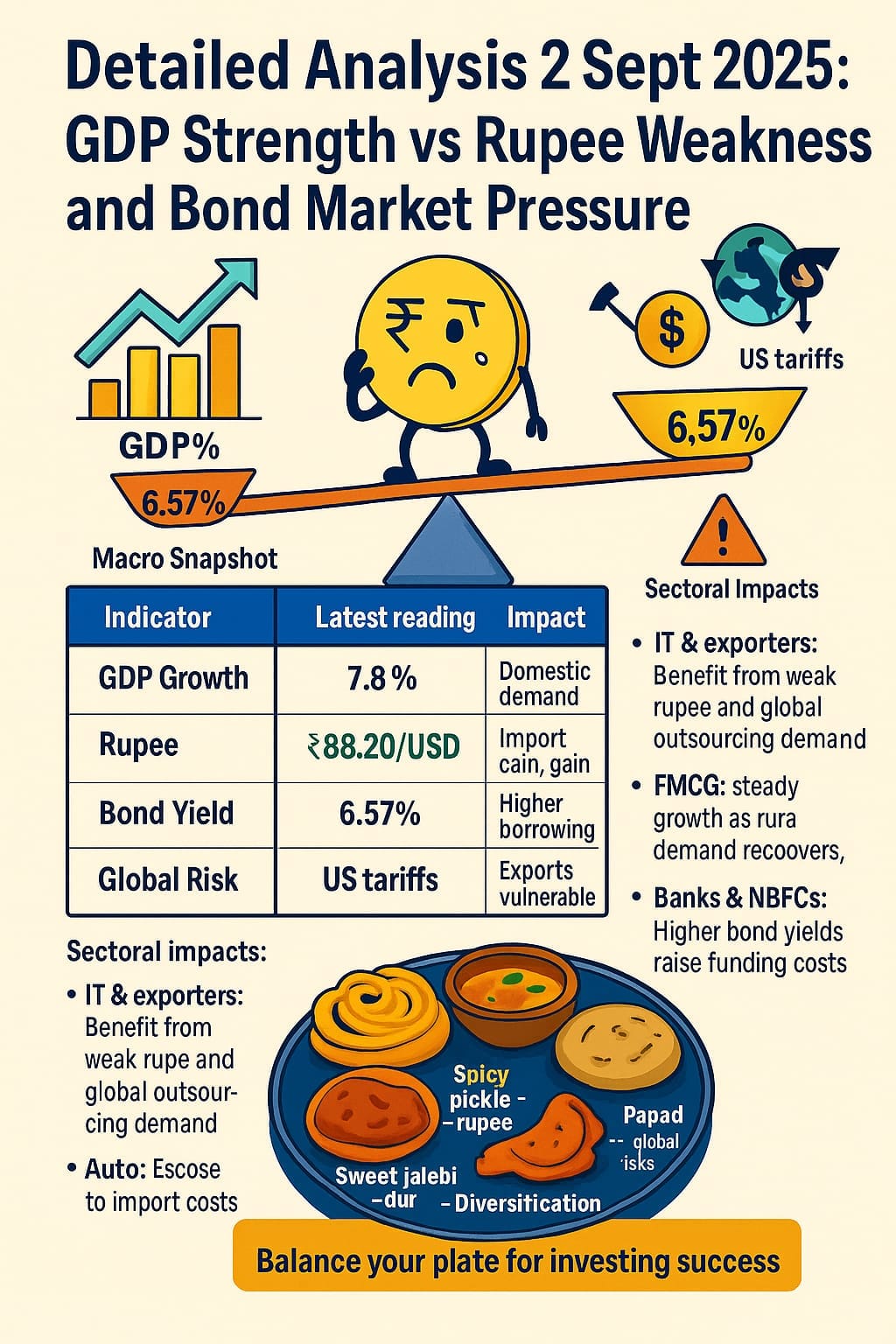

The Detailed Analysis 2 Sept 2025 highlights the sharp contrast between domestic growth and external stress. While GDP surprised with a stellar 7.8%, the rupee remains fragile at ₹88+, bond yields are under upward pressure, and trade risks from U.S. tariffs continue to cloud the outlook. Investors face a mixed thali—sweet GDP dessert with spicy rupee pain and bond-market indigestion.

📊 GDP Growth – India’s Strong Pulse

India’s Q1 FY26 GDP grew by 7.8%, beating estimates. Services and consumption drove the surge, reflecting India’s resilient domestic demand. Analysts note that government capital expenditure and festive-season demand added extra fuel. (TOI)

Yet, some economists caution that the deflator effect may have overstated growth. HSBC analysts argue real GDP may be flattered by low inflation assumptions. (FT)

For aam investors, this feels like hearing India beat Pakistan in cricket—joyful, confidence-boosting, but not a guarantee of winning the World Cup. Sustained growth depends on investments, jobs, and global demand.

💸 Rupee Weakness – Currency Pain

The rupee touched an all-time low of ₹88.33 against the U.S. dollar on Sept 1 before recovering slightly to ₹88.20 with RBI intervention. The fall reflects trade deficits, FPI outflows, and tariff tensions. (Reuters)

For common Indians, rupee weakness is like onion prices doubling during Navratri—daily life feels more expensive. Imported crude, electronics, and edible oils pinch pockets, while IT exporters smile at better dollar revenue.

🏦 Bond Market Pressure – Rising Yields

India’s 10-year benchmark yield rose to 6.57% today, after August saw a 19 bps jump. Fiscal deficit concerns and higher borrowing add stress. (ET CFO)

The RBI faces a dharam-sankat: support the rupee, manage inflation, and still fund the government’s borrowing. Bond strategists like Axis MF advise tactical long-duration bets to capture re-pricing opportunities. (ET Markets)

🌍 Global Cues – Trade War Shadows

Global mood is cautious. U.S. tariffs on Indian exports (up to 50%) weigh heavily. ADB has cut India’s FY26 forecast to 6.5% citing trade risks. (TOI)

Wall Street awaits U.S. jobs data, Asian markets trade modestly higher, and crude holds near $78/bbl—limiting inflation fears. For Indian equities, this is like riding a Mumbai local during peak hours—crowded, bumpy, but still moving forward.

🏭 Sectoral Impacts

- IT & Exporters: Benefit from weak rupee and global outsourcing demand.

- Auto: Strong on festive demand but vulnerable to import costs.

- FMCG: Steady growth as rural demand recovers; GST reform hopes add fuel.

- Banks & NBFCs: Higher bond yields raise funding costs; credit growth steady.

- Energy & PSU: Strong performance as crude stabilizes and reforms provide tailwinds.

📋 Macro Snapshot – Detailed Analysis 2 Sept 2025

| Indicator | Latest Reading | Impact |

|---|---|---|

| GDP Growth | 7.8% Q1 FY26 | Domestic demand boost |

| Rupee | ₹88.20/USD | Import pain, export gain |

| Bond Yield | 6.57% | Higher borrowing costs |

| Current Account | $2.4B deficit | Wider trade gap |

| Global Risk | US tariffs | Exports vulnerable |

👥 Human + Indian Touch

The Detailed Analysis 2 Sept 2025 is like a thali meal—GDP is the sweet jalebi, rupee weakness is the spicy pickle, bond yields are the heavy dal, and global risks are the papad that may break anytime. Together, they make the plate complete, but balance is key. For investors, discipline is like roti—without it, the thali feels incomplete.

❓ FAQs – Detailed Analysis 2 Sept 2025

- Q1. Why did GDP surprise at 7.8%?

Driven by services, consumption, and government spending. Some economists doubt sustainability. - Q2. Why is the rupee weak?

Tariffs, trade deficit, and capital outflows. RBI support keeps it near ₹88.20. - Q3. What do rising bond yields mean?

Higher borrowing costs for corporates and government; investors see tactical bond opportunities.

🔎 People Also Ask

- Q4. Will India’s growth continue?

If domestic demand and capex sustain, yes. But global risks may trim momentum. - Q5. Is the rupee fall good for anyone?

Yes, IT exporters and remittance earners benefit. Import-heavy sectors suffer. - Q6. How should retail investors respond?

Diversify. Stick with quality stocks. SIPs in equity mutual funds remain a safe long-term bet.

✅ Conclusion

The Detailed Analysis 2 Sept 2025 reflects India’s growth strength and external vulnerabilities. GDP growth offers comfort, rupee weakness demands caution, and bond yields signal stress. For investors, the message is clear: enjoy the jalebi of growth, but don’t ignore the spicy pickle of currency and the heavy dal of bonds. Balance your plate, diversify your investments, and stay focused on the long game.