Macro Overview: Global Signals & Federal Expectations

The global backdrop is humming with optimism. A softer U.S. labor market has reignited hopes of a Federal Reserve rate cut in the near term, nudging the S&P 500 and Nasdaq into green zones earlier today. The U.S. two-year Treasury yield dropped to 3.59%, a four-month low—paving smoother paths for emerging markets like India.

India’s Bond Market & Fiscal Pulse

Closer to home, Indian government bonds edged higher as fears of fiscal strain eased, thanks to the sliding GST burden. The benchmark 10-year yield dipped to 6.48%, signaling a vote of confidence from both domestic and global investors. (ET Markets)

GST Revisions: A Boon to Consumption & Margins

Following swift action from the GST Council, tax slabs have been rationalized into just 5% and 18%, ending the four-tier structure. While tax relief is scheduled from 22 September, market participants are already placing faith in its power to boost consumption, especially in auto, FMCG and retail sectors. (AInvest)

Rupee Woes: New Lows & RBI Interventions

The Indian rupee slumped to a record ₹88.36 per U.S. dollar amid tariff anxieties, before stabilizing following intervention from the Reserve Bank of India via state-owned banks. Dealers now expect the rupee to settle in mildly volatile ranges, around ₹88.10–88.20. (Reuters)

Exporters aren’t passive either—lobby groups are pushing for a weakened rupee to offset U.S. tariffs of up to 50%, while analysts forecast a gradual descent toward ₹89 by early 2026 if conditions deteriorate. (Reuters)

India-US Trade Tensions & Export Challenges

India’s exports have taken a hit from this month’s 50% U.S. tariffs—a sharp escalation in the ongoing trade standoff. Exports to the U.S., especially labor-intensive items, face up to a third of their value eroded. Meanwhile, India’s FX reserves dipped by $9 billion in August as RBI stepped in to support the currency. (Reuters)

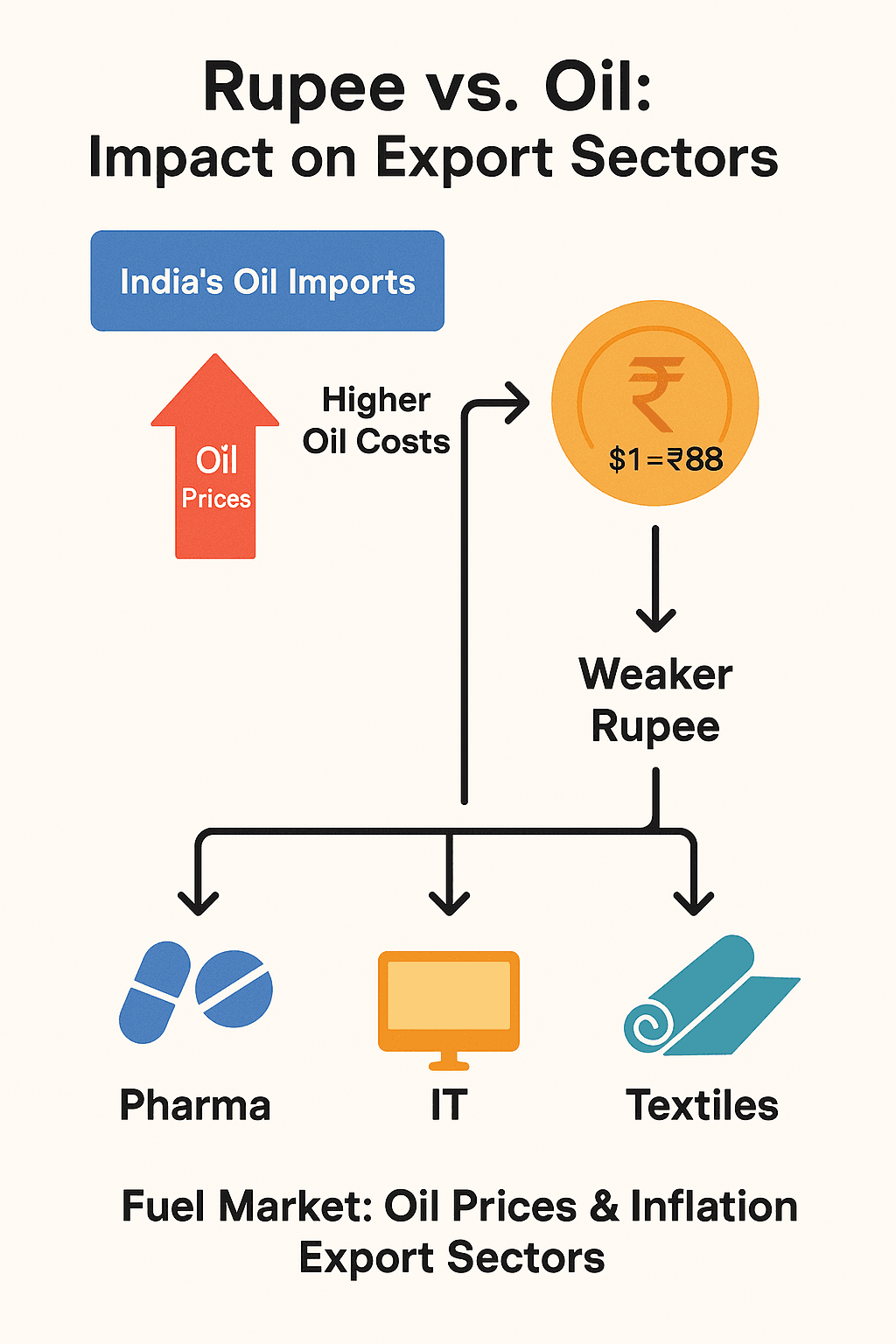

Fuel Market: Oil Prices & Inflation Watch

Crude oil trades steady near $76 a barrel, but remains a focus area—India’s heavy reliance on imported oil (over 80%) makes it vulnerable to spikes. Though global energy markets are stable today, a sudden uptick could spur inflation and tilt consumer-centric sectors via rising costs. (Wiki – Oil Industry)

Sectoral Impact: Winners & Watchlists

- Exports: Benefitted by the weaker rupee, but wary of falling order books due to U.S. pricing pressures.

- IT & Pharma: Global margin pressure persists; forex impact negative, but adaptability remains high.

- Auto & FMCG: GST cuts are already baked into forward-looking value—sector strength remains intact.

- Banks & NBFCs: Mixed reactions—liquidity is softening, but credit demand ahead of festive season is a silver lining.

Retail Investor View: Real-World Impact

Picture an Indian kitchen planning for Diwali. While the rupee slipping is like noticing each ingredient costing more, GST relief is the surprise coupon bringing down the total. It’s a balancing act—households will stretch, but will still feel the pinch. Same with investors—they’ll welcome news of rates easing but remain cautious of persistent inflation and trade shocks.

FAQs

- Q1. How will the Fed rate cut benefit India?

It can boost FPI inflows and ease global borrowing rates, helping markets and liquidity. - Q2. Does GST welfare not outweigh rupee pain?

Yes, especially for consumption-driven sectors; but inflation and energy costs remain concerns. - Q3. Should exporters count on rupee weakness?

Yes, but margins will still be tested due to high tariffs and shipping/logistic costs.

People Also Ask

- Will the rupee slide further or find stability soon?

- How far will the GST reform boost auto and FMCG sales?

- Are banks positioned to benefit from year-end credit demand?

- When could the Fed announce a rate cut?

Conclusion

Today’s **Detailed Market Insight – 5 Sept 2025** is a blend of optimism and caution. Global rate-cut expectations and GST reform provide strong tailwinds, while US tariffs and a weakened rupee throw challenges. Investors should diversify: play auto and consumption for near-term momentum, but modulate exposure in IT and exports if currency pressure persists. In today’s environment, picking the right sectors is as important as timing the entrance.