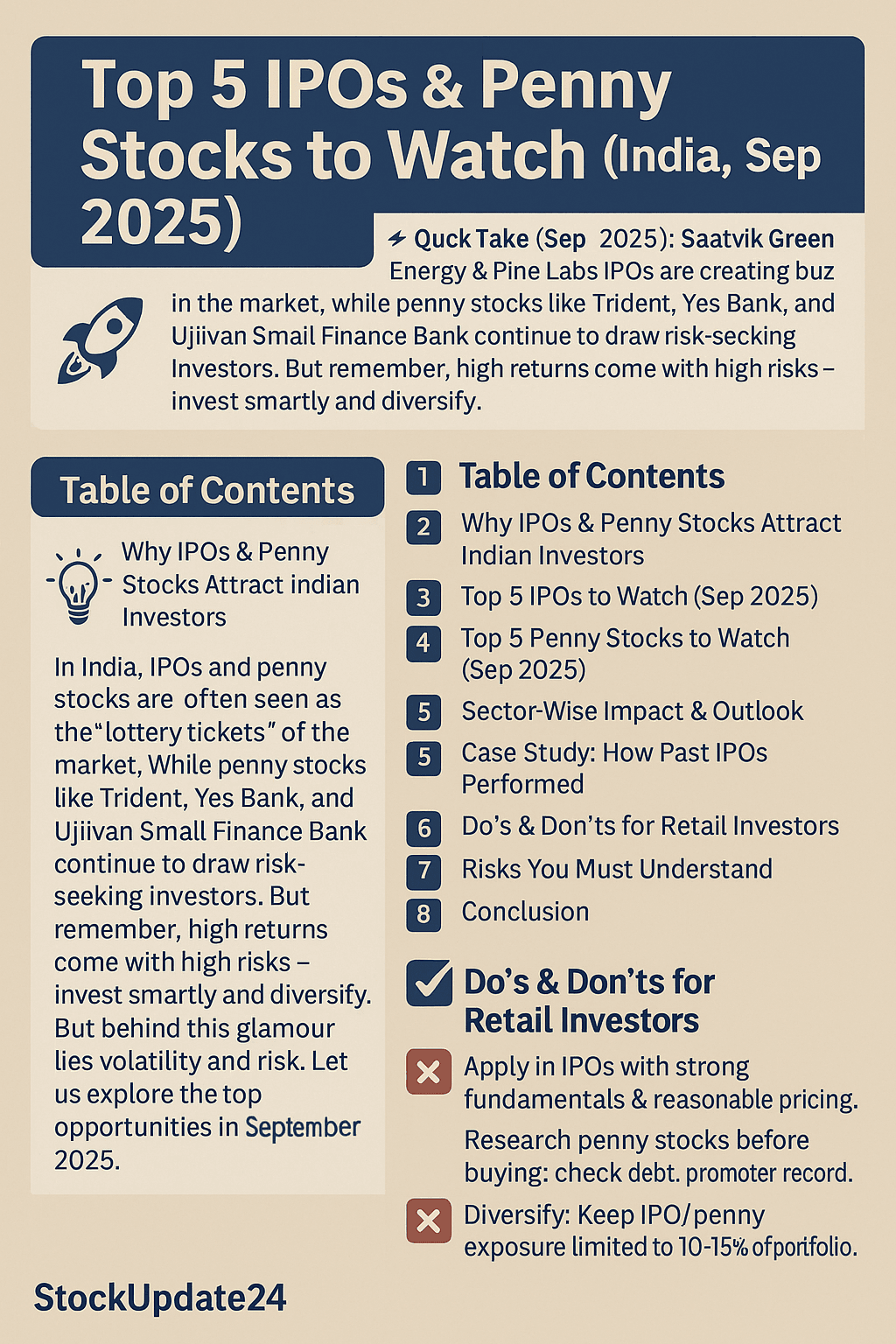

🚀 Quick Take (Sep 2025): Saatvik Green Energy & Pine Labs IPOs are creating buzz in the market, while penny stocks like Trident, Yes Bank, and Ujjivan Small Finance Bank continue to draw risk-seeking investors. But remember, high returns come with high risks — invest smartly and diversify.

📑 Table of Contents

- Why IPOs & Penny Stocks Attract Indian Investors

- Top 5 IPOs to Watch (Sep 2025)

- Top 5 Penny Stocks to Watch (Sep 2025)

- Sector-Wise Impact & Outlook

- Case Study: How Past IPOs Performed

- Do’s & Don’ts for Retail Investors

- Risks You Must Understand

- Conclusion

- FAQs

💡 Why IPOs & Penny Stocks Attract Indian Investors

In India, IPOs and penny stocks are often seen as the “lottery tickets” of the stock market. IPOs bring fresh companies to the stock exchange — from fintech to green energy — and create huge excitement. Penny stocks, on the other hand, are low-priced shares that promise multibagger returns if the company succeeds. But behind this glamour lies volatility and risk. Let us explore the top opportunities in September 2025.

📌 Top 5 IPOs to Watch (Sep 2025)

- Saatvik Green Energy IPO

– Opening around 19 Sept 2025 ([NBT Report](https://navbharattimes.indiatimes.com/business/share-market/share-news/saatvik-green-energy-ipo-to-open-on-september-19-check-price-band-and-other-detail-here/articleshow/123919088.cms?utm_source=chatgpt.com)) – Sector: Renewable / Solar – Why Watch: Green energy is a core government focus, and investors love sustainability plays. – Risk: Capital-intensive business; depends on subsidies and policies. - Pine Labs IPO

– SEBI approved ([Economic Times](https://m.economictimes.com/markets/ipos/fpos/pine-labs-hero-motors-canara-robeco-amc-and-3-others-get-sebi-nod-for-ipos/articleshow/123902793.cms?utm_source=chatgpt.com)) – Sector: Fintech & Digital Payments – Why Watch: Strong brand in merchant payments; could be India’s next fintech giant. – Risk: Competitive industry, valuations may be high. - Hero Motors IPO

– SEBI nod received – Sector: Auto / EV – Why Watch: Strong brand, expanding into EVs, auto demand rising. – Risk: EV transition costs, global supply chain issues. - Canara Robeco AMC IPO

– Sector: Asset Management – Why Watch: Stable revenue, growing mutual fund industry in India. – Risk: Competition from HDFC AMC, SBI MF etc. - Manipal Payment & Identity Solutions

– Sector: Digital Payments & ID Tech – Why Watch: Part of India’s digital ecosystem growth. – Risk: Niche space, scalability untested.

💹 Top 5 Penny Stocks to Watch (Sep 2025)

- Trident Ltd – Textiles & paper, strong export base. Seen momentum recently. [Source: Samco](https://www.samco.in/knowledge-center/articles/best-penny-stocks-to-buy-now-in-india/?utm_source=chatgpt.com)

- Yes Bank Ltd – Turnaround story, improved NPAs, restructured balance sheet. Still speculative. [Source: Bajaj Finserv](https://www.bajajfinserv.in/what-are-penny-stocks?utm_source=chatgpt.com)

- Ujjivan Small Finance Bank – Strong fundamentals, niche in small finance space. [Source: Samco](https://www.samco.in/knowledge-center/articles/best-penny-stocks-to-buy-now-in-india/?utm_source=chatgpt.com)

- Easy Trip Planners Ltd – Travel sector revival play. Cheap valuation, but cyclical risk.

- Nila Spaces Ltd – Affordable housing & real estate. Pure speculative pick.

🏭 Sector-Wise Impact & Outlook

– Fintech: Pine Labs IPO will test investor appetite after Paytm/Zomato volatility. – Auto/EV: Hero Motors’ IPO comes at the right time; EV adoption is rising. – Asset Management: Canara Robeco AMC can benefit from booming SIP culture in India. – Green Energy: Saatvik Green reflects India’s renewable future. – Real Estate/Infra: Penny stocks like Nila Spaces may gain if housing demand picks up.

📖 Case Study: How Past IPOs Performed

Remember Zomato’s IPO in 2021? It listed at a premium, soared, but later corrected sharply. Paytm’s IPO also saw a massive listing-day fall. Lesson? IPO hype doesn’t always guarantee returns. On the other hand, IRCTC & DMart gave multibagger returns over the years. The key is valuation, sector strength, and long-term fundamentals.

✔️ Do’s & Don’ts for Retail Investors

Do’s:

- Apply in IPOs with strong fundamentals & reasonable pricing.

- Research penny stocks before buying; check debt, promoter record.

- Diversify: Keep IPO/penny exposure limited to 10-15% of portfolio.

- Use SIPs for stability in mutual funds alongside these high-risk plays.

Don’ts:

- Don’t chase IPO hype blindly.

- Don’t invest all savings in penny stocks.

- Don’t ignore exit strategy — penny stocks can turn illiquid quickly.

⚠️ Risks You Must Understand

- Penny stocks are highly volatile and illiquid.

- IPOs may list below issue price if overvalued.

- Regulatory changes, global interest rates, or crude oil shocks can derail momentum.

✅ Conclusion

IPOs & penny stocks in Sep 2025 are exciting but risky. Saatvik Green, Pine Labs, and Hero Motors IPOs may capture investor imagination. Penny stocks like Trident, Yes Bank, and Ujjivan SFB are speculative plays. Balance is key — mix stable large caps and SIPs with selective exposure here. 👉 Stay tuned to StockUpdate24.com for real-time IPO & penny stock updates.

❓ FAQs

- Q: Which IPO is opening this week?

A: Saatvik Green Energy IPO is opening around 19 Sept 2025. - Q: Which penny stocks are hot now?

A: Trident, Yes Bank, and Ujjivan SFB are trending, but all carry high risk. - Q: Should I invest in Pine Labs IPO?

A: If you believe in fintech growth, yes — but valuations matter. Do research. - Q: Can penny stocks make me rich?

A: Yes, but they can also wipe out capital. Don’t overexpose. - Q: How to balance risk?

A: Keep 80-85% in stable investments, and only 10-15% in IPO/penny plays.

© 2025 StockUpdate24. Informational content only. Not investment advice.