📰 Introduction

On 29 August 2025, the Indian stock market witnessed a pause in momentum by mid-day. Nifty is consolidating around the 24,725 level, while Sensex is trading close to 80,400 points. The day’s clear outperformers are Auto and FMCG stocks, giving a cushion to investors, while Metals and IT sectors remain under pressure. Simply put, the morning cheer has cooled into mid-day consolidation.

📊 Market Snapshot (12 Noon)

- Nifty 50: ~24,725 (up about 20 points)

- Sensex: ~80,400 (up 200 points) (LiveMint)

- Bank Nifty: ~52,300 (rangebound with no major action)

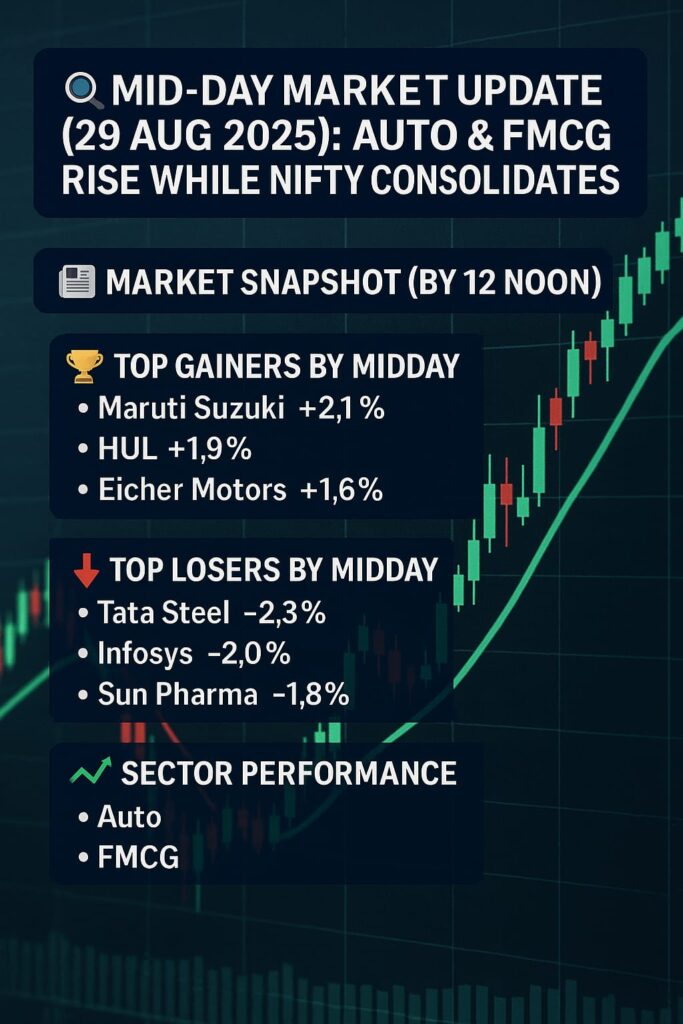

🏆 Top Gainers (Mid-Day)

- Maruti Suzuki – +2.1%, supported by festive-season demand optimism (ET Markets).

- HUL – +1.9%, steady demand for daily essentials.

- Eicher Motors – +1.6%, strong premium two-wheeler and export demand.

- ITC – +1.4%, defensive buying trend continues.

- Nestlé India – +1.0%, stable packaged food demand.

📉 Top Losers (Mid-Day)

- Tata Steel – -2.3%, impacted by tariff-related pressures (Reuters).

- Infosys – -2.0%, IT export demand outlook under strain.

- Sun Pharma – -1.8%, facing global regulatory headwinds.

- Reliance Industries – -1.5%, crude oil volatility weighing on sentiment.

- HDFC Bank – -1.2%, cautious tone amid persistent FII outflows (Moneycontrol Live).

📈 Sector Performance

- Auto: The star sector of the day—Maruti and Eicher leading on strong pre-festival demand.

- FMCG: HUL, ITC, and Nestlé proving to be safe havens for investors.

- Metals: Tata Steel and Hindalco under tariff-driven pressure.

- IT: Infosys and TCS subdued amid weak export outlook.

- Banks: HDFC Bank dragging sentiment, others mostly flat.

💡 Investor Strategy

🔹 Short-Term Traders

Play momentum in Auto and FMCG stocks, but keep tight stop-losses to manage volatility.

🔹 Medium-Term Investors

Auto stocks may benefit from festive demand, while FMCG ensures steady performance.

🔹 Long-Term Investors

Focus on quality blue-chip names such as Maruti, HUL, and ITC. Use dips for accumulation (LiveMint Analysis).

❓ Frequently Asked Questions (FAQ)

- Q1. How is Nifty performing at mid-day today?

A. Nifty is consolidating around 24,725 with Auto and FMCG lending support, while Metals and IT remain weak. - Q2. Which are the top gainers at mid-day?

A. Maruti Suzuki, HUL, and Eicher Motors are among the biggest gainers. - Q3. Which stocks are under pressure?

A. Tata Steel, Infosys, and Sun Pharma are leading the losers’ pack. - Q4. Which sectors should investors focus on?

A. Auto and FMCG sectors look promising due to strong demand and defensive stability. - Q5. What’s the best short-term trading strategy?

A. Stick to momentum trades in Auto and FMCG with strict stop-losses to manage volatility.

✅ Conclusion

By mid-day on 29 August 2025, the Indian markets are showing resilience despite tariff pressures. Nifty remains steady near 24,725, Sensex is up 200 points, and Auto & FMCG sectors are leading the way. Metals and IT continue to weigh on sentiment, but investors should keep an eye on the 24,800 mark as a key resistance level. The day is shaping up as a tug-of-war between domestic resilience and global uncertainties.