📰 Executive Summary

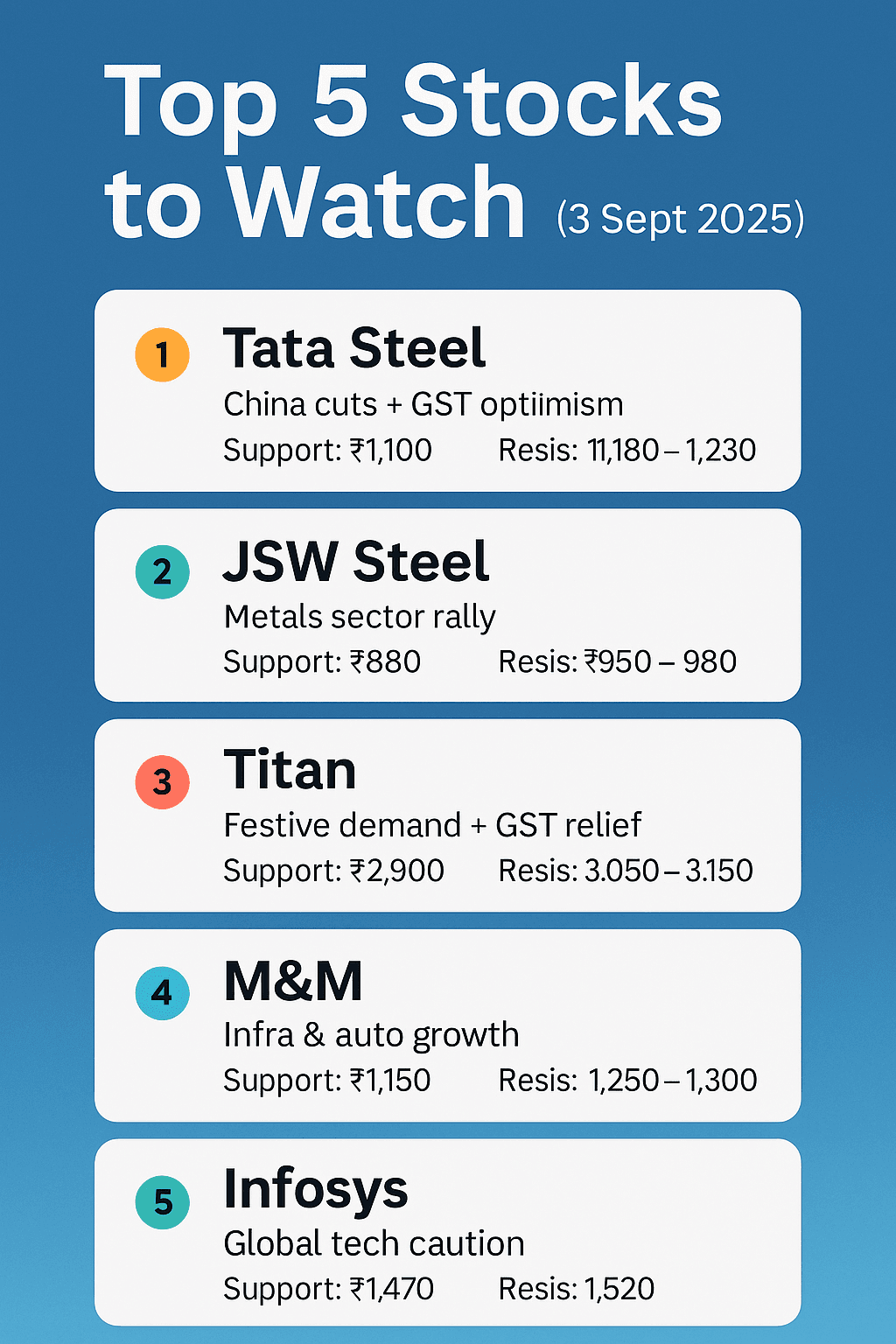

Dalal Street started 3 September 2025 on a strong footing, with Nifty reclaiming 24,700 and Sensex surging over 400 points. Within this broader optimism, five stocks emerged as key movers: Tata Steel, JSW Steel, Titan, Mahindra & Mahindra (M&M), and Infosys. Metals saw robust demand due to China’s capacity cuts, Titan benefitted from festive optimism, M&M rallied on infra push, while Infosys underperformed tech peers. Let’s dive deeper into why these five are the Top 5 Stocks to Watch Today. (TOI, ET)

1. Tata Steel – Riding the Global Metal Wave

Why in focus? Tata Steel led the rally with a sharp 6% surge as investors cheered China’s decision to impose fresh capacity cuts and India’s GST council hinting at relief measures for the sector. Support: ₹1,100 | Resistance: ₹1,180 Technical insight: A strong breakout above 1,180 may open gates to 1,230. Volumes spiked 2.5x, showing FII participation. Human touch: Metals feel like the “bread and butter” of India’s infra story. For an Indian investor, Tata Steel is not just a stock, it’s part of every bridge and every building we see around us. (Economic Times)

2. JSW Steel – Sector-wide Momentum

JSW Steel too gained ~3% as the entire metals basket rallied. Brokerage reports suggest that margins may expand in Q3FY25 due to lower input costs. Support: ₹880 | Resistance: ₹950 Technical insight: Breakout above 900 has opened short-term targets of 950–980. Indian touch: For retail investors in small towns, JSW is often seen as “Bade log ka share,” but today’s momentum makes it a hot intraday pick even for retail traders. (Mint)

3. Titan – Festive Season Cheer

Why watch? Titan climbed 2% as festive demand, GST rationalisation hopes, and gold jewellery demand supported the stock. Reports suggest higher footfalls in showrooms ahead of Ganesh Chaturthi. Support: ₹2,900 | Resistance: ₹3,050 Technical insight: A daily close above 3,050 could trigger a rally towards 3,150. Human touch: Every Indian family connects with Titan—be it Tanishq for weddings or Fastrack watches for college students. Titan’s rally is not just market-driven, it reflects Indian sentiment during festivals. (ET Now)

4. Mahindra & Mahindra (M&M) – Auto & Infra Push

M&M rose 2.5% as government’s infra and rural push boosted auto sales expectations. Strong SUV sales and tractor demand remain key drivers. Support: ₹1,150 | Resistance: ₹1,250 Technical insight: A breakout above 1,200 is bullish; target 1,280–1,300 in short term. Indian touch: M&M tractors are part of every Indian village’s story. As Bharat gears up for the festive harvest, M&M reflects rural India’s heartbeat. (ET)

5. Infosys – Tech Under Pressure

Why watch? Infosys slipped 1.2% despite positive market sentiment. Weak global tech demand and cautious IT budgets in the US weighed on the stock. Support: ₹1,470 | Resistance: ₹1,520 Technical insight: Short-term weakness, but long-term investors see value near 1,450. Human touch: Every Indian IT aspirant dreams of Infosys, and even a small slip feels personal to lakhs of families connected to India’s IT story. (MarketWatch)

🔎 Snapshot Table

| Stock | Momentum Driver | Support | Resistance |

|---|---|---|---|

| Tata Steel | China cuts + GST optimism | ₹1,100 | ₹1,180–1,230 |

| JSW Steel | Metals sector rally | ₹880 | ₹950–980 |

| Titan | Festive demand + GST relief | ₹2,900 | ₹3,050–3,150 |

| M&M | Infra & auto growth | ₹1,150 | ₹1,250–1,300 |

| Infosys | Global tech caution | ₹1,470 | ₹1,520 |

📊 Sectoral Context

– Metals: Global supply curbs + GST relief hopes – Autos: Rural demand + infra spending – Consumer: Festive optimism – IT: Global uncertainty, cautious budgets

🇮🇳 Retail Investor’s View

Aam investors in India compare today’s stocks to “festive sweets.” Tata Steel and JSW are like hot jalebis – tempting and in demand. Titan is like kaju katli, a must-have in festivals. M&M feels like laddus from villages, while Infosys today tastes a bit bitter, like karela in thali—necessary, but tough to swallow.

❓ FAQs

- Q1. Why are Tata Steel and JSW in focus?

China’s production cuts and India’s GST relief hopes boosted metal stocks. - Q2. Is Titan a safe buy?

Yes, festive demand and GST rationalisation support Titan’s momentum. - Q3. Why is Infosys weak?

Global IT spending slowdown is impacting sentiment. - Q4. Should I buy M&M now?

If you believe in India’s rural and infra push, M&M has long-term strength.

🔎 People Also Ask

- Will metal stocks rally continue? Likely, as both global and domestic cues remain supportive.

- Is Titan only a festive play? Not entirely—its jewellery and lifestyle segments drive steady growth.

- Can Infosys bounce back? Yes, if global IT budgets stabilise in Q4FY25.

✅ Conclusion

Today’s Top 5 Stocks to Watch (3 Sept 2025) reflect a mix of India’s growth story: – Tata Steel & JSW Steel for infra and global metals – Titan for consumer spirit – M&M for rural + infra growth – Infosys for India’s tech backbone. For retail investors, the message is clear: ride the momentum but never forget stop-loss. Markets are like Mumbai rains—beautiful, powerful, but unpredictable.